5 Mistaken Beliefs About Bitcoin

Despite being over 12 years old, there are still many misconceptions about Bitcoin.

In this article, we will review 5 mistaken beliefs about the leading cryptocurrency:

- "Bitcoin is anonymous",

- "Bitcoin is mainly used by criminals",

- "Bitcoin is too volatile",

- "Bitcoin mining is wasteful", and

- "Bitcoin is backed by nothing".

1. "Bitcoin is Anonymous"

Bitcoin is often perceived as anonymous, but it is actually pseudonymous. You don't use your legal name to use the Bitcoin protocol, so your identity is hidden in a sense. But you can be identified by the public addresses that you use, which can potentially be traced back to an IP address or an exchange account.

Any given bitcoins are owned by an address, the balance of which is publicly visible along with the entire history of transactions. These bitcoin addresses are just a long string of letters and numbers, and it’s not always clear which wallet is connected to a particular person or business. Anyone can create as many addresses as they want or they can use multi-signature addresses (which are jointly controlled by more than one person).

When funds are moved from your wallet, anyone can see the outflow by entering your address into a block explorer to observe the amount of bitcoin sent, the time the transaction was made, and to which address the funds were sent. Any bitcoins received from an exchange that requires identification can potentially tie certain individuals and addresses together. This could also apply to anyone being paid for their products/services in bitcoin, using a donation address on their website, and so on.

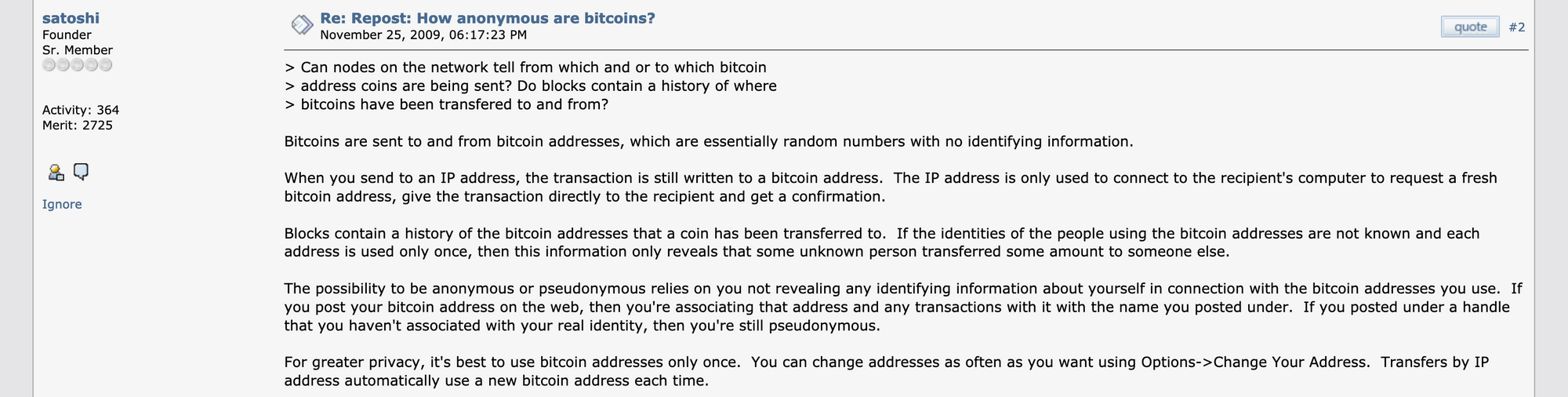

Basically, it’s bad privacy etiquette to declare a bitcoin address you’ve used to the world, since it will show all of your transactions and your past/current balances. Satoshi himself recommended to never re-use a bitcoin address because of the network's pseudonymity and the privacy implications of linking an address to your real-world identity:

There are some workarounds for privacy (such as running your own full node, using P2P markets and coin mixing techniques), but there are no default privacy measures in Bitcoin. A lot of information can be gleaned about you depending on how you use the network (i.e., if you use a full node, a KYC exchange, and so on).

2. "Bitcoin is Mainly Used by Criminals"

Bitcoin was at one point synonymous with the Dark Web. But in recent times, bitcoin has shaken off that image as cryptocurrencies have become recognised by traditional finance players as a new asset class with a lot of potential. New technologies are often adopted by underground markets first and is a testament to their utility: in bitcoin's case, as an instrument to transfer value over the internet.

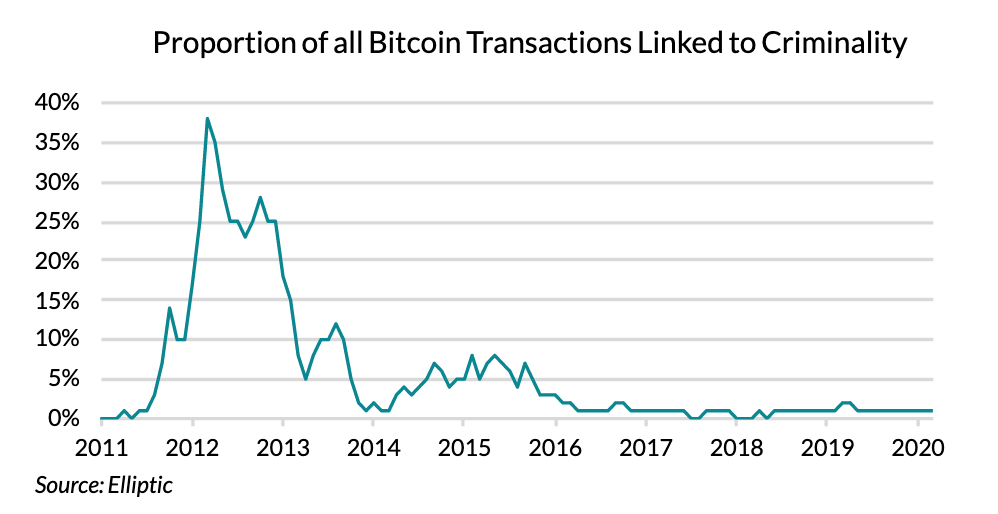

Because of Bitcoin's transparent nature, a whole industry of blockchain analytics has sprung up and developed sophisticated techniques to trace criminal activities related to cryptocurrencies. Data from blockchain analytics firm Elliptic shows that the share of Bitcoin’s market associated with illicit activities has fallen over time, from a peak of 35% of all transactions in early 2012 to less than 1% at present.

Bitcoin is just a tool (like cash) which can be used for good or bad purposes. Most criminal activity still involves fiat currencies, where the illicit activity taking place on all blockchains is surpassed by crimes facilitated by currencies such as the US Dollar or euro.

3. "Bitcoin is too Volatile"

Bitcoin is said to be a store of value, but many people have pointed out that the digital currency is too volatile. How can you store value in bitcoin if the price has a tendency to move wildly and could drop a couple thousand dollars minutes after you purchase it?

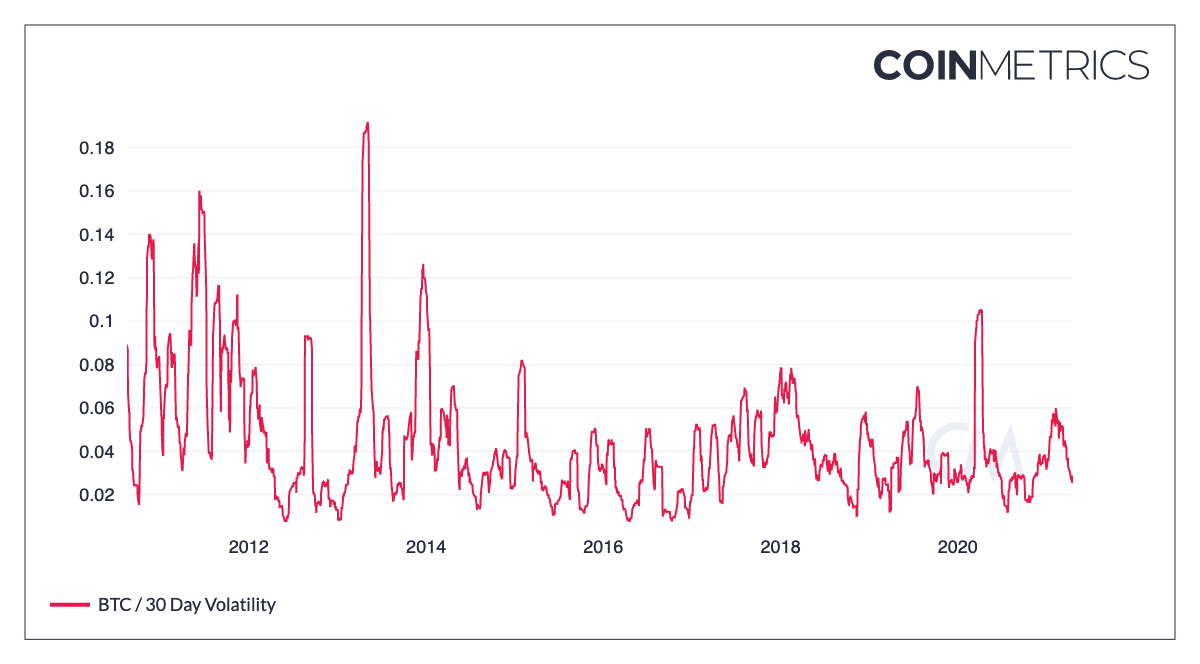

Compared to other assets, the moves in the price of bitcoin moves look far more exaggerated, but its volatility stems from the fact it is more of a free market than other assets. While the volatility appears high, it has actually fallen over time for bitcoin as the cryptocurrency has matured.

As the network grows and bitcoin realises it's potential as an accepted store of value like gold, the volatility is expected to continue falling over time as the price stabilises once adoption is much more widespread than it is now. Even though the wild price swings may be too much to stomach for some, over the long term, it has rewarded bitcoin investors who have persevered.

4. "Bitcoin Mining is Wasteful"

You may have heard that the Bitcoin network consumes as much energy as a small country. For example, a recent article reports the cryptocurrency consumes more energy than the United Arab Emirates, a whopping 120 Terawatt-hours per year.

The concern is that fossil fuels are used to generate the electricity required for Proof of Work mining to secure the Bitcoin network, which contributes to greenhouse gas emissions. This contribution to climate change is a cost borne by society at large, even if they are not using Bitcoin.

But similar to precious metals, energy, resources and time are required to mine bitcoin (and this makes these commodities valuable) as we can think these assets of as captured energy. For instance, the energy requirements to re-write the Bitcoin blockchain are massive, and this is exactly what makes the network so secure by ensuring transactions are immutable (i.e., they cannot be reversed or changed). No other form of money provides immutability like bitcoin does, so it's a net positive for society.

Um no. Immutability is not a waste of energy. Christmas lights are a waste of energy

— Andreas (BEWARE of giveaway scams!) (@aantonop) November 19, 2017

It's also worth noting that the Bitcoin network's energy requirements are much lower than the traditional financial system, such as payment networks like Visa and Mastercard, which have much larger overhead costs (especially when including the electricity consumed to keep a network of banks and ATMs running).

Another point is that Bitcoin uses energy that would be otherwise wasted, giving a use case for stranded energy - which can be then converted into bitcoin and transferred globally. Bitcoin miners want the cheapest energy sources, so they often use sources of energy that have little demand and would be wasted otherwise - for instance, stranded oil or gas wells in North America.

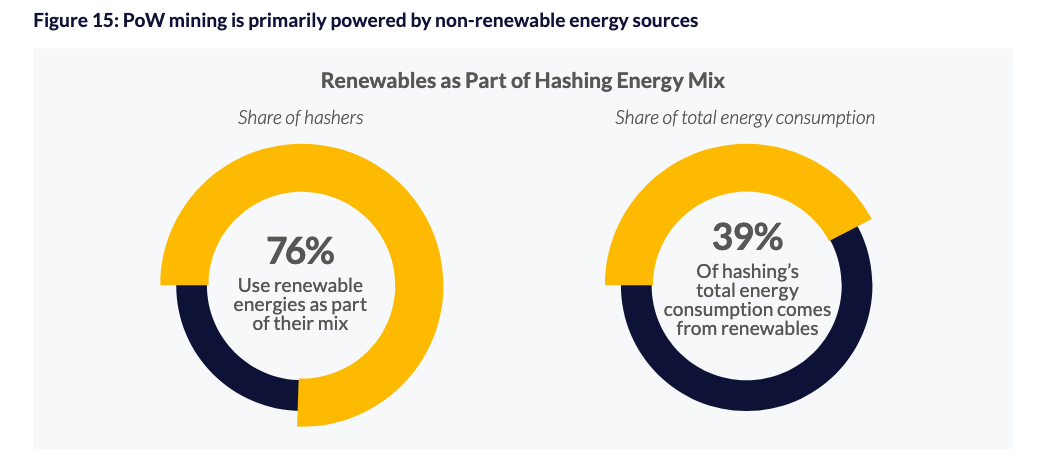

Also, Bitcoin is actually a lot greener than people think. According to estimates from the 3rd Global Cryptoasset Benchmarking report by the Cambridge Center for Alternative Finance, 76% of miners use renewable energy (especially hydroelectric power) as a part of their energy mix, and 39% of their total energy consumption is derived from renewables:

The Cambridge Center for Alternative Finance also estimates that total carbon dioxide emissions from bitcoin mining would not exceed 58 million tons, or 0.17% of total global carbon dioxide emissions, even if coal was the only energy source used by bitcoin miners.

5. "Bitcoin is Backed by Nothing"

Critics of Bitcoin such as Nouriel Roubini claim that bitcoin is backed by nothing, has zero value and depends on the ‘greater fool’ theory (someone will buy bitcoin in the hopes they can sell it to someone else at a later date, at a higher price).

Fiat money only has value because it is backed by governments. But trust in governments has been eroded countless times (recently in Venezuela and Zimbabwe) where inflation can be used as a stealth tax or a form of economic oppression. Even without hyperinflation, fiat money is not backed by anything.

Take a look at a banknote. You'll notice it says something like "I promise to pay the bearer on demand" or "this note is legal tender for all debts, public or private", which basically means all fiat currencies are based on a promise. While governments have backed fiat currencies through debt since the gold standard was abolished in 1971, Bitcoin doesn't rely on a promise or debt, but on cryptography.

The US Dollar's motto is 'In God We Trust' while Bitcoin's motto is 'In Cryptography We Trust'.

Source: photo by Jorge Salvador / Unsplash.

While Bitcoin doesn't generate cash flows like stocks or possess industrial utility like precious metals, it is backed by the code and consensus amongst the ecosystem’s participants, namely developers, miners, nodes and users.

These groups work together to advance the code since they value bitcoin as a scarce digital asset and a censorship-resistant form of money. As more and more people recognise Bitcoin's value as well as the inner workings, talented minds have become increasingly gravitated towards the ecosystem because of the advantages offered over both fiat and gold.

Bitcoin is a complex beast and there are constructive criticisms to be made. But often the criticisms you may hear are usually result from a lack of knowledge of how the digital currency actually works. While we have only outlined 5 common misconceptions about bitcoin, there are many other myths that are perpetuated because of the complicated nature and nuances involved in the world of cryptocurrencies.

-The Rollbit Team