Is Bitcoin a Good Investment?

Should you invest in Bitcoin? Read on to find out both the bull case and bear case for the leading cryptocurrency!

With bitcoin recently reaching fresh all-time highs above $64,000, many people may wonder, "is it still worth investing in Bitcoin?". Let's take a step back and look at the bigger picture.

Where are we at with cryptocurrency?

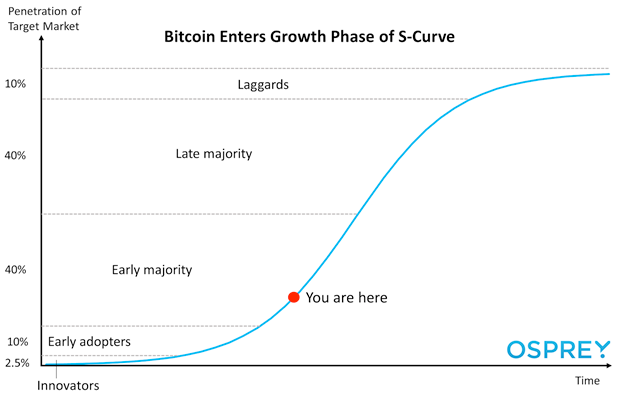

Since the inception of bitcoin back in 2009, it remains the leading cryptocurrency and the most valuable blockchain network. A useful concept for tracking the potential of bitcoin is the S-curve for technological innovations, which tells us that despite the massive appreciation of BTC over the years, you're still early to the cryptocurrency party:

The S-Curve breaks global adoption into several stages: innovators, early adopters, early majority, late majority, and laggards. Most of the growth comes from the early majority and late majority stages. Currently, we are somewhere in the early majority stage for bitcoin, suggesting time is still on your side if you haven't invested yet.

But nothing in life is risk free. While there are a lot of opportunities to invest and profit, there are also risks to be aware of when putting your money into bitcoin. Therefore, we thought it'd be useful for our readers to summarize both the bull case and the bear case for bitcoin.

Let's look at the bull case first.

The Bull Case for Bitcoin

A bitcoin bull will tell you it's still worth investing in bitcoin even at this stage because:

- Bitcoin is an improvement over gold, a traditional store of value, and is often termed as 'Digital Gold' (or 'Gold 2.0'),

- Bitcoin is censorship resistant money, it is a hedge against inflation and provides a tool for people living under oppressive regimes, and

- Bitcoin has a first-mover advantage, so it's likely to remain in the top spot as the most liquid and most valuable cryptocurrency with the largest network,

Bitcoin is 'Digital Gold'

Bitcoin shares many properties with gold that make it valuable, such as scarcity and verifiability. The supply schedule for Bitcoin is predictable and unchangeable, with the supply currently growing at around 1.7% per year and there will only ever be a maximum of 21 million coins.

Bitcoin can be verified using a full node which is a computer that is connected to the network, helps to broadcast transactions and maintains a copy of the entire transaction history to enforce certain rules (such as rejecting an invalid transaction that 'double spend'), which is a bit like testing to your own gold to make sure you've actually got ownership what you think you've got.

However, bitcoin improves on gold as a sound form of money: first, digital currencies are more portable (you can fit as many BTC as you want on a USD or a piece of paper with your mnemonic seed, whereas you'd only be able to fit a certain amount of gold into a briefcase).

Second, bitcoin is also much more divisible than any other form of money that has ever existed: the smallest unit of Bitcoin is known as a 'satoshi', where 100 million units satoshis (or sats) is equal to 1 BTC. On the other hand, investors may encounter difficulty when trying to buy small amounts of gold, as the precious metal is typically sold as kilos, ounces, half ounces, and quarter ounces in bars or coins.

Third, while you can have full custody of both gold and bitcoin, verifying what you own is much more of an issue with gold. This is because of counterfeit gold bars that have been discovered in the market. In contrast, bitcoin cannot be counterfeited.

Bitcoin is therefore the next step in the natural evolution of money from barter, to items like sea shells, to gold, metal coins, paper money, credit cards, electronic money and finally digital currency. If bitcoin were to replace gold as a store of value and investment, then bitcoin’s market capitalization would increase approximately 10 times from the current network value of around $1.1 trillion to $10 trillion, which would place the price of bitcoin near $540,000.

Bitcoin is Censorship-resistant Money

No central authority can manipulate or seize bitcoin since every transaction is just like exchanging cash - it is peer-to-peer. In particular, bitcoins are yours and there is no central authority that issues bitcoin, owns it, or controls it. With some knowledge about how to manage your public and private keys, you can make it difficult for any potential attacker to seize your coins.

Subscribe up to our blog to get more cryptocurrency content in the future, such as a detailed article on public/private key management to help you secure your BTC!

Unless a thief somehow accesses the private keys associated with your wallet, your bitcoins are safe and a lot harder to steal than anything that is physical, like cash, credit cards, or gold. The way Bitcoin is designed also makes transactions more secure. For instance, you do not reveal any sensitive information (as with credit cards) and it isn't prone to chargeback fraud (a big problem for credit cards and payment platforms like PayPal), since not long after a transaction has been confirmed by the network, it is pretty much irreversible.

Bitcoin is also more censorship resistant than physical assets like cash, gold or real estate, which can be more easily seized by governments or a group of 'bad guys'. Digital currencies can be stored online in an encrypted file or offline using a hardware/paper wallet.

Another related aspect of bitcoin that it is an inflation hedge, providing a lifeboat for people living in countries with high inflation or hyperinflation. Hyperinflation is where the prices of goods and services increase rapidly over time at a much faster rate than the growth in income. Many currencies have seen sharp declines against the US Dollar over the past few years: the Zimbabwean Dollar, the Venezuelan bolivar, the Iranian rial, and the Turkish Lira are a few notable examples.

Bitcoin's First Mover Advantage

Bitcoin has a strong competitive advantage over other cryptocurrencies by being first to market, enjoying recognition across the globe, the highest liquidity and a large, loyal community. The concept of first-mover advantage is best exemplified by companies like Sony, which enjoyed a lead in the market for personal stereos and their brand name is synonymous with that product. However, other companies have failed completely even after being the first mover, such as Xerox.

Out of all cryptocurrencies, Bitcoin has the strongest network effect thanks to its first mover advantage. There are estimated to be around 101 million crypto users worldwide according to Cambridge's Center for Alternative Finance, with most using BTC. Bitcoin also has the highest number of active addresses out of any cryptocurrency, which implies it has the largest user base.

As the number of participants grows, the value of the network will increase. The network has expanded over time - at first, cryptographers, libertarians and computer nerds were interested in this new form of money, then traders, then gamers, and so on, up until now where institutions and corporations are getting in on bitcoin. Metcalfe’s law tells us that the value of a network is proportional to the number of participants and as the network size grows, so too does the valuation.

In the past year, the entry of institutional investors and traditional finance is enlarging the network and pushed the price to new highs. Companies are beginning to acquire bitcoin for their corporate treasuries, which not only expands the value in line with Metcalfe’s law but also reduces the available supply even further. Nearly 8% of all bitcoin are held in corporate treasuries at the moment, so it is still worth investing in bitcoin according to bulls, since you’d want to get in before more companies add the digital currency to their corporate treasuries.

The network effect does not just relate to investors and users. It also applies to developers, who maintain the software and make improvements to Bitcoin. Some of the most talented people in the world are working on Bitcoin, with one of the most competent and largest developer communities out of any software project. For instance, over 130 individuals contributed to the latest Bitcoin Core release. As hedge fund manager Paul Tudor Jones remarked, "A bet on bitcoin is a bet on human ingenuity".

Now let's take a look at the bear case.

The Bear Case for Bitcoin

A bitcoin bear will usually make at least one of the following points when explaining their case that it isn't worth investing in bitcoin:

- Regulatory risk: governments move slow but they may regulate cryptocurrencies in such a way to stifle the movement. A hostile regulatory stance, especially on a global scale, could diminish bitcoin's desirable properties and reverse the gains seen over the past few years.

- Protocol Risk: all software will suffer from bugs at one point or another. The risk with Bitcoin is that there is a bug so bad that it permanently affects confidence in the cryptocurrency. There's also the risk that the protocol does not improve in terms of scalability and fungibility, making transactions expensive and discouraging adoption.

- Another cryptocurrency might capture a second-mover advantage. Technological advancements that can facilitate a more scalable and fungible cryptocurrency could also make Bitcoin obsolete or less relevant in the future. Also, because of the protocol risks, a cryptocurrency based on its own novel code base might provide an alternative for cryptocurrency users if Bitcoin suffers from a disastrous bug.

Regulatory Risk

One of the biggest threats to Bitcoin is a coordinated state-level attack. This could be a ban on the use of privacy-enhancing protocols on bitcoin, a shutdown of exchanges, or even an outright ban on Bitcoin altogether. While efforts to ban bitcoin would be in vain, the regulations around cryptocurrency are likely to remain fluid within and between jurisdictions, and could adversely affect the value of the network in the future if things take a turn for the worst.

One potential scenario is that the US President issues an Executive Order against bitcoin and other cryptocurrencies, which would dampen the bullish outlook. It's been done in the past, such as Executive Order 6102, which banned the holding of physical gold in the US in the 1930s. While it would more difficult to do with bitcoin since it is digital, governments could also apply pressure to bitcoin by seeking more control and oversight of the on- and off-ramps, such as exchanges, payment processors and so on.

Another scenario is that the central bankers of the world come together and pressure governments and organisations like the IMF to issue an outright ban on bitcoin. It doesn't matter if something is scarce, if governments and global organisations become hostile, the value of the network would likely drop massively. Once countries have their own digital currency systems in place, they may attempt to discourage the use of bitcoin, by making it illegal, introducing penalties/jail time for users, and so on.

Another point related to regulatory risk stems from the fact that most of the mining is concentrated in China. The risk here is that if the Chinese authorities enact hostile regulation (for example, nationalisation of Bitcoin mining) before it becomes more decentralised. Such an event could affect the qualities of censorship resistance of bitcoin and consequently reduce the network's value.

Protocol Risk

While Bitcoin has certain advantages over assets like gold, it has not yet stood the test of time. Gold, unlike bitcoin, has existed as a valuable and scarce commodity for thousands of years, and it's unlikely that the association between the yellow metal and money will break in many people's minds. As time goes on, the risk for bitcoin is that a disastrous bug in the software that has no fix (or is not fixed in time) could affect confidence and permanently push the value of bitcoin lower.

Software has been broken in the past, even with hundreds of developers looking over the code. For example, in 2010 Bitcoin suffered from an integer overflow bug (known as CVE-2010-5139) that led to 184 billion bitcoins being created out of thin air. Luckily, the bug was fixed, but it may have remained unnoticed if the attacker created a smaller number of coins instead of 184 billion, which stood out like a sore thumb.

Other aspects of protocol risk are things like 51% attacks (where miners with enough hashing power collude to 'double spend' bitcoin), and contentious hard forks that could split the community even further (like with the Bitcoin-Bitcoin Cash split in August 2017), which has the effect of diluting the network effect.

The Bitcoin protocol also suffers limitations in both fungibility and scalability. Without adequate scaling to increase the number of transactions per second, the network will be too slow and expensive to use for most people, limiting adoption. If the size of the network reaches a plateau and the number of new participants slows down or comes to a complete hault, the value of bitcoin according to Metcalfe's law will become more stable, making investing in it less profitable. This scenario also means we'd be less likely to see phenomenal gains that we've witnessed in the past.

In the absence of improvements to fungibility, the Bitcoin network could eventually split in two between those addresses with 'clean' bitcoins and those with 'dirty' bitcoins, each carrying different market values. Already there are blacklists for certain bitcoin addresses, and anyone interacting with these addresses will face legal consequences, effectively reducing the utility of those coins.

Another Cryptocurrency Captures a Second Mover Advantage

Late entrants to the cryptocurrency market may pounce on Bitcoin’s weaknesses, improve it and capture a second-mover advantage, surpassing it in both usage and network value. The second-mover advantage is best illustrated by Facebook, which surpassed social networks that were first to market (such as MySpace). Although it remains to be seen if there will be an altcoin that can capture a second-mover advantage and topple bitcoin as the most valuable blockchain network, it is a possibility.

For instance, other popular blockchains such as Ethereum have sought to expand the remit of cryptocurrency beyond just money, implementing smart contracts and enabling decentralized applications. Privacy coins have implemented an essential feature of money (fungibility) that bitcoin lacks. A new technology may come along in the future that could be used to build a better cryptocurrency. So far it hasn't happened, but that doesn't mean it cannot happen in the future.

The whole cryptocurrency market is based on open source technology and it is full of innovation; bitcoin might eventually be replaced by something else. Of course, the network effects are powerful and bitcoin will most likely never be killed off completely, but that its position as a leader could be challenged in the long term.

Are you a bitcoin bull or a bitcoin bear? Let us know (and why) on Discord or via Twitter.-The Rollbit Team