The Crypto Pulse October 4th

Rollbit's weekly analysis and review of the news in Bitcoin, Ethereum, NFTs and cryptocurrency markets.

Rollbit's weekly analysis and review of the news in Bitcoin, Ethereum, NFTs and cryptocurrency markets.

News 📰

DeFi Whales Turned Central, Northern and Western Europe into the World’s Biggest Cryptocurrency Economy

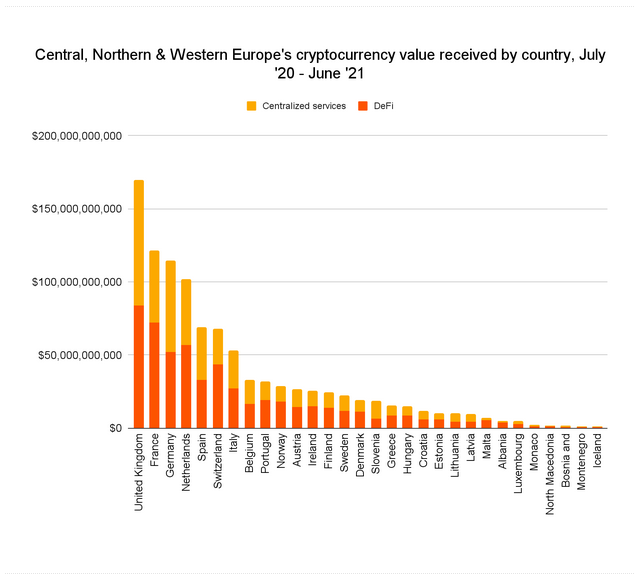

According to Chainalysis, Central, Northern & Western Europe is now the largest crypto economy in the world following the clampdown in China. Over the last year, this region has received over $1 trillion worth of cryptocurrency, representing 25% of global activity.

The top 5 countries driving this activity in Europe are the United Kingdom, France, Germany, the Netherlands and Switzerland.

Axie Infinity's Native AXS Token Reaches All-time High on Staking Announcement

Axie Infinity announced the launch of staking for AXS and a plan for an airdrop for its users on September 30th. The price of AXS has consistently printed fresh highs following the announcement, reaching as high as $155 on October 4th.

AXS staking is live!

— Axie Infinity🦇🔊 (@AxieInfinity) September 30, 2021

• Stake AXS here: https://t.co/N3uHT9Lx9b

• Staking guide: https://t.co/s7fyKJ93cw

• We are distributing AXS tokens to our founding community member’s Ronin wallets based on the snapshot taken on October 26th, 2020.

Full article: https://t.co/JxScs9PHLh pic.twitter.com/qI6vD7PcNW

Gain exposure to AXS via our Crypto Portfolio feature!

NFL and Dapper Labs Plan to Launch an American Football-focused NFT Market

The National Football League (NFL), NFL Players Association (NFLPA) and Dapper Labs (creators of the Flow blockchain which hosts the popular NFT project NBA TopShot), are thought to be planning an American football-oriented NFT marketplace.

The NFL and NFLPA will reportedly acquire equity in Dapper Labs, with the new American football NFT marketplace predicted to arrive in early January 2022.

Get exposure to FLOW via our Crypto Portfolio feature!

Twitter Exec Shares ‘Sneak Peek’ of NFT Profile Verification

You'll soon be able to get your NFTs verified and receive a check mark similar to the blue check mark given to verified Twitter users to show that you are the true owner of an avatar.

Justin Taylor, Twitter’s head of consumer marketing, tweeted a video on September 29th showing a sneak peek of how NFT verification will work. While just an experimental feature that could still change before release, it gives us an idea of what's coming for NFT profile verification on Twitter.

Here’s a sneak peek👀 on what we’re working on for NFT profile verification.

— Justin Taylor (@TheSmarmyBum) September 29, 2021

What do you think? pic.twitter.com/Z8c6tH3BBy

Other News

- On September 30th, the Terra network underwent the biggest upgrade yet, Columbus-5. The major change is the adoption of inter-blockchain communication, which will connect Terra-based assets such as the stablecoin TerraUSD (UST) to the Cosmos ecosystem. LUNA experienced bullish price action following the Columbus-5 upgrade, rising from $33 and reaching a fresh all-time high near $50 on October 4th.

- TikTok is launching Top Moments with top NFT creators collaborating with the most popular accounts on the social media network. Powered by layer 2 NFT protocol Immutable X and available on Ethereum, TikTok's Top Moments features six 'culturally significant TikTok videos' as one-of-one digital tokens.

- On October 1st, Federal Reserve chairman Jerome Powell stated that the US central bank will not ban Bitcoin (BTC) like China has done, easing fears of a regulatory clampdown on cryptocurrencies in the Western world. The price of Bitcoin jumped on Powell's comments, displaying the largest daily percentage gain since June 6th, 2021 and regaining the important $45,000 level.

- Grayscale adds Solana (SOL) to $494 million digital large cap fund on October 2nd, allocating 3.24% to the sixth largest cryptocurrency by market cap. Grayscale also added the 13th most valuable cryptocurrency, Uniswap's governance token (UNI).

- The SEC delayed a decision on four Bitcoin Exchange-traded Funds (ETFs) on October 3rd, shifting deadlines into late November and December. SEC Chair Gary Gensler recently expressed interest in a bitcoin ETF tied to futures under the Investment Company Act of 1940, raising hopes of an ETF approval (and a potential catalyst for another bullish wave in the crypto market) by the end of 2021.

Market Analysis 📈📉

7-day Price Change

- BTC: +13.1%

- ETH: +11.1%

- ADA: -0.5%

- BNB: +23.7%

- SOL: +24.6%

- XRP: +10.0%

- DOGE: +10.3%

- LINK: +9.5%

- LTC: +11.7%

- TRX: +5.8%

Data as of October 4th, 19:30 UTC

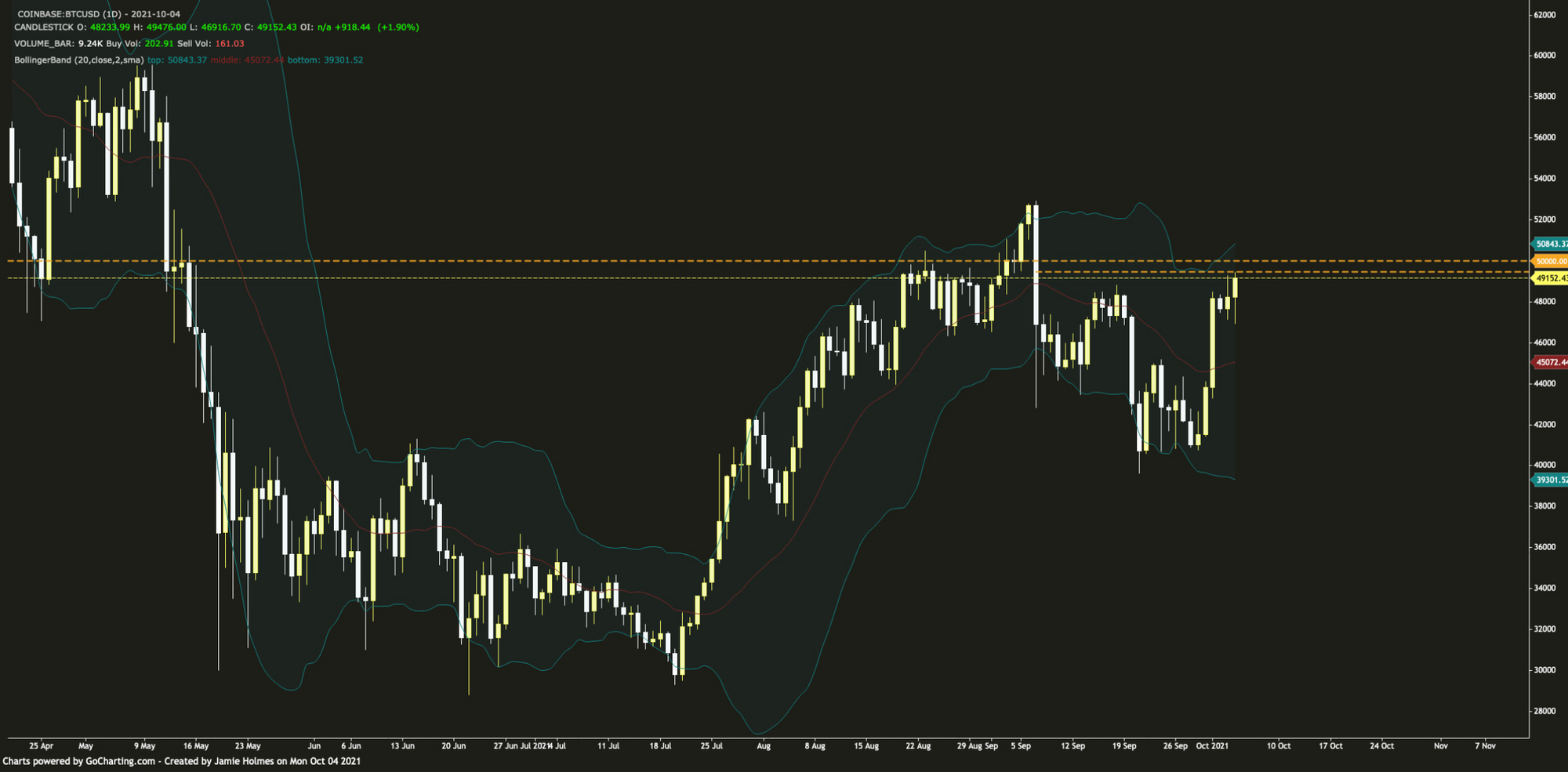

Let's look at the Bitcoin chart.

The daily chart shows that BTC-USD bounced away from the lower Bollinger Band on September 29th and continued moving upwards, reaching the highest level in almost one month on October 3rd, near $49,500. The $50,000 psychological level is a key level to watch going forward, with a daily close above this price likely to lead to further gains in the week ahead.

Bitcoin has still not recovered from September 7th's drop yet, but a sustained rise above the $49,800 level will paint a bullish outlook. The $49,800 level is the mid-point of the large bearish candlestick on September 7th and a rise above this level will suggest that buyers are wrestling back control of the market from sellers. The middle and lower Bollinger Bands are at $45,072 and just below $40,000 on the daily chart, which should act as support levels if the market reverses.

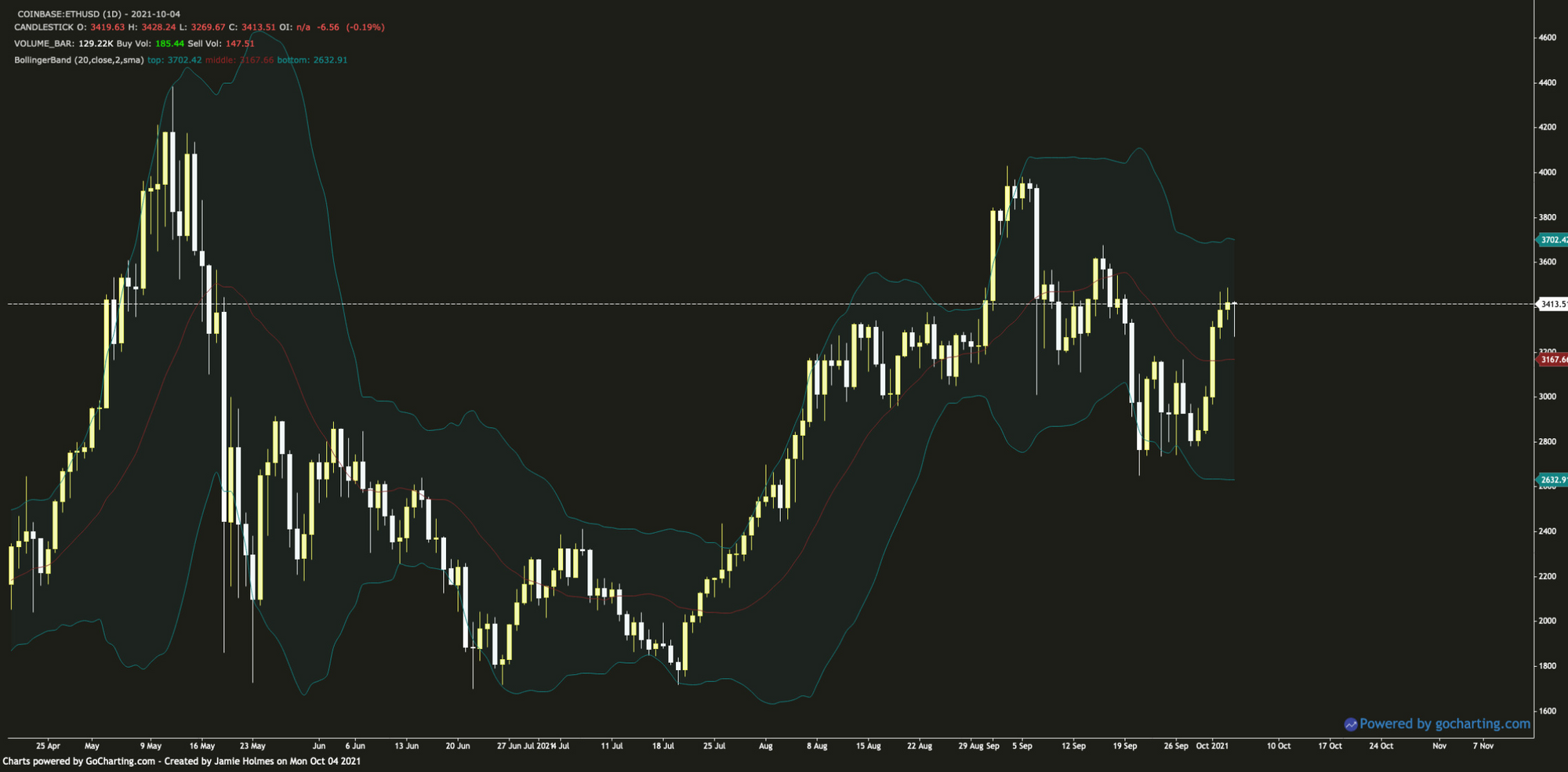

Ethereum's ETH has followed a similar pattern to BTC, rising on September 29th from around $2,800 and regaining the important $3,000 level, rising to highs near $3,500 on October 3rd. However, unlike Bitcoin, ETH has not yet made a higher high, still trading below the September 16th high of $3,675.

The upper Bollinger Band lies at $3,702, suggesting ETH-USD has room to go higher before a potential correction. The middle band has flattened out and should provide support near $3,167 in the event of a downturn.

Solana's SOL has shown a remarkable recovery, surpassing the important $152 level and looks to be heading back towards the $200 handle. The price of SOL is currently trading near $170 and we may see a bit of a pullback this week as the market has reached the upper Bollinger Band at $175.75 on October 3rd.

The nearest support level on the daily chart lies at the middle band near $148, which would be a good level to buy SOL if there's a downturn. On the other hand, a daily close above the upper Bollinger Band (currently ~$178), then this would indicate a breakout and we'd expect a move towards $190-$200 to materialise.

Have a great week!

-The Rollbit team