What Are Non-Fungible Tokens (NFTs)?

A brief guide to everything you need to know about Non-Fungible Tokens (NFTs) and blockchain-based gaming.

Imagine if you could go back in time and snap up some first edition Pokemon cards. Cryptocurrencies are providing another opportunity to acquire collectibles that have the potential be worth a lot more in the future: Non-Fungible Tokens.

Non-Fungible Tokens (or NFTs) are cryptocurrency tokens that represent scarce, digital collectibles which are also indivisible and unique. The term ‘non-fungible’ just means that the tokens are distinguishable from each other and cannot be interchanged.

Cash is fungible since a $100 bill is interchangeable with any other $100 note. Cryptocurrencies like Bitcoin and Ethereum are fungible (at least, in theory) in the sense that each unit should be worth the same as any other (1 BTC = 1 BTC).

On the other hand, NFTs are not interchangeable. Each Non-Fungible Token is built on a smart contract that contains specific information that makes it unique, with the code verifying that it is the only digital asset with certain characteristics.

The ownership of art, collectibles, decentralized domain names, in-game items, music, virtual real estate (and much more) can be represented by NFTs. Similar to a Pokemon card, you cannot divide a NFT up into fractions. They are also distinguishable from each other, in the same way a shiny Blastoise card can differ from another shiny Blastoise in various aspects, such as whether it is in mint condition, whether it is a first edition and so on.

But some advantages of NFTs over traditional collectibles (such as your shiny Blastoise) are that the scarcity can be proven, and since they are digital, they're more durable. Every transfer is recorded on the blockchain, so you can cryptographically verify the historical prices and the ownership history through the underlying blockchain protocol.

Additionally, it is much easier to transfer NFTs as compared to their physical counterparts, since these collectibles live on public ledgers. Such a transfer can be made at any time, anywhere, and doesn’t rely on a broker or any other intermediary: all that is required is an internet connection and some crypto. Compared with selling a piece of art or a physical collectible, the logistics can be much more straightforward for NFTs.

Any smart contract platform can support NFTs. Some examples of public blockchains hosting NFTs include Ethereum, Flow, and WAX, with the most popular NFTs on each of these blockchains (based on all-time sales volume) being CryptoPunks, NBA Top Shot, and Street Fighter respectively.

A Brief History of Non-Fungible Tokens (NFTs)

Most NFT activity today resides on Ethereum, but some of the first NFTs were actually built on top of Bitcoin. NFTs can trace their lineage back to coloured coins, which enabled assets to be represented on Bitcoin, but its growth was limited by the blockchain's scripting capabilities. Following coloured coins, the Counterparty protocol was launched in 2014 to achieve the aim of issuing assets on the Bitcoin blockchain.

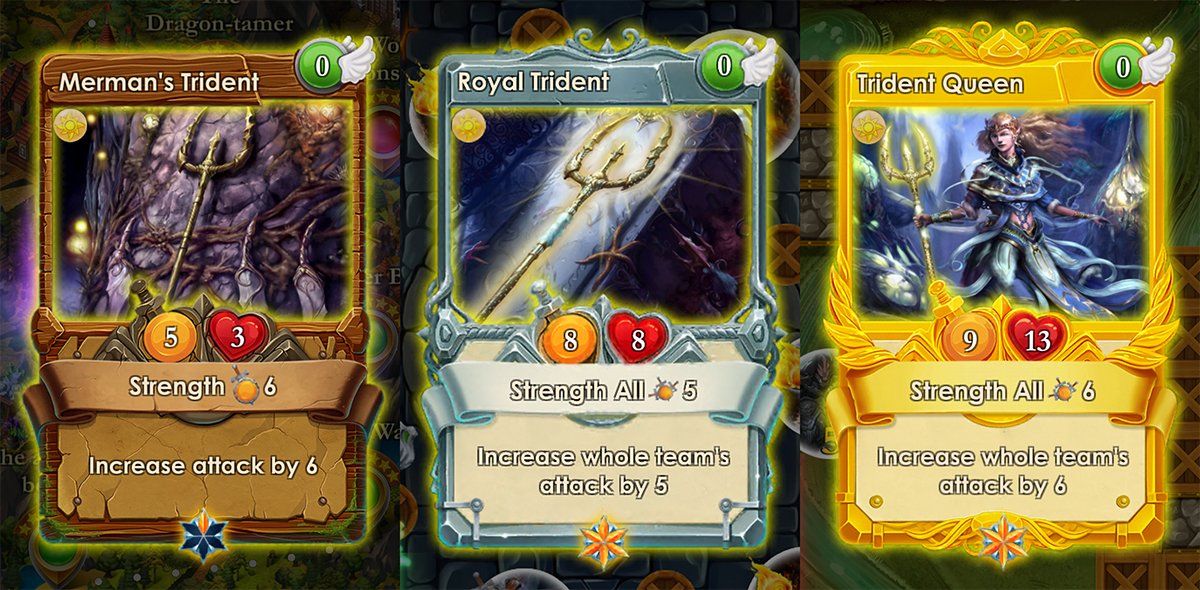

Spells of Genesis, which was launched in April 2015 on Counterparty, is considered the first blockchain-based game and revamped trading cards for the digital age, putting these in-game assets onto the blockchain. Players have to collect and combine cards to create the strongest deck in order to fight their enemies:

Another digital trading card project launched on the Counterparty platform in October 2016: Rare Pepes. Rare Pepe memes were transformed into provably rare, digital trading cards and are valued on their rarity, with the 'Nakamoto Pepe' having a 'Rareness Score' of 97:

Larva Labs took the idea of unique digital collectibles on the blockchain even further, and combined this concept with generative art to create CryptoPunks, which launched in June 2017. These NFTs are 24x24 pixel art images that are generated algorithmically:

Most of these CryptoPunks are guys and girls, but there are a few rarer types such as aliens, apes and zombies. Every punk has their own profile page that shows their attributes as well as their ownership or for-sale status. Noone can modify these punks, which will forever live on the Ethereum blockchain.

There are only 10,000 CryptoPunks in existence. Initially, they could be claimed by anyone with an Ethereum address, but were quickly snapped up. Since then, they have become the most highly valued NFTs since they are amongst the oldest digital collectibles associated with Ethereum.

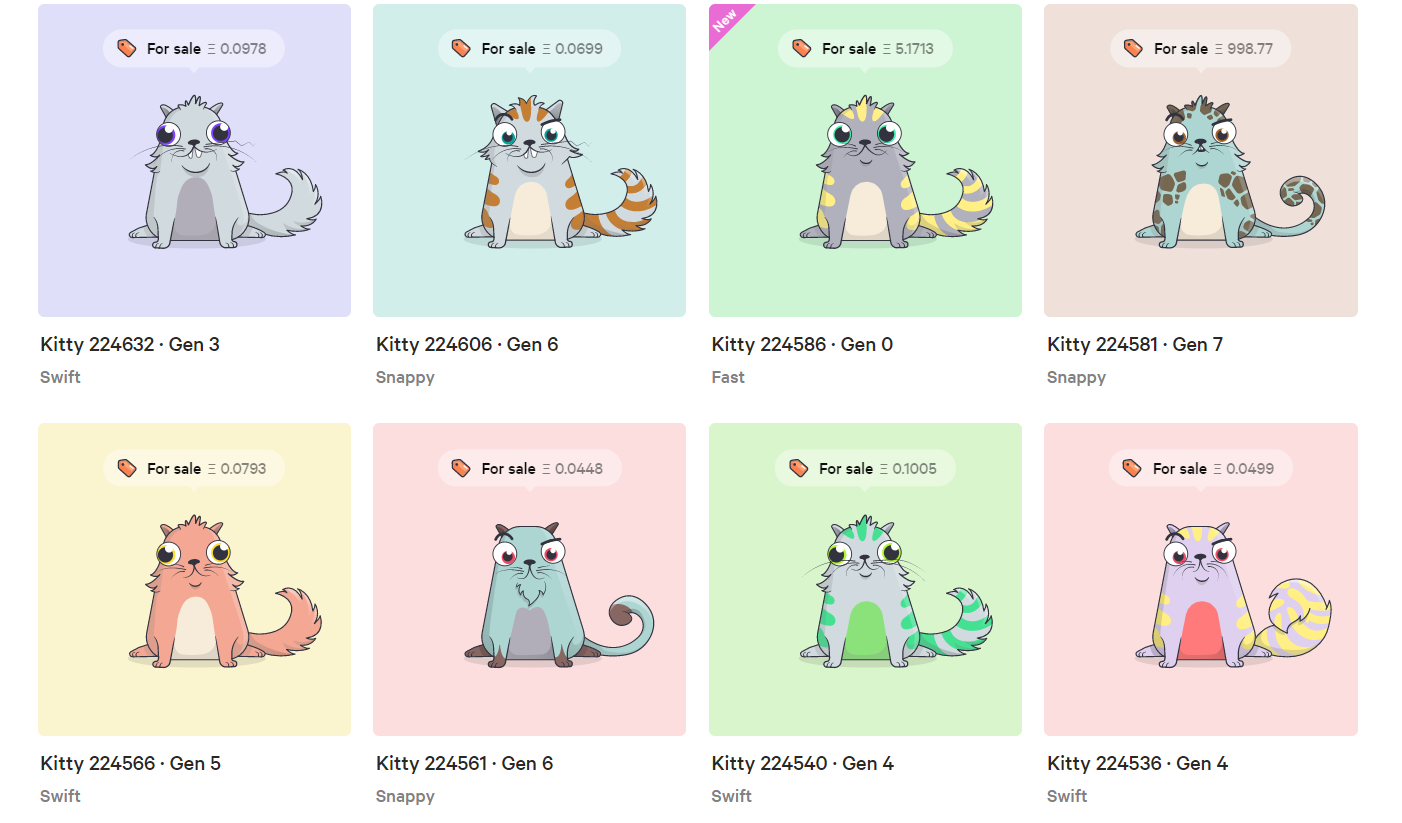

The NFT hype didn’t reach fever pitch until November 2017, after the launch of CryptoKitties on the Ethereum blockchain. Developed by Axiom Zen, CryptoKitties combined the concept of digital collectibles with some aspects of gaming, allowing players to buy, sell and breed digital cats, which were all unique due to their genetics being encoded onto the blockchain:

Prior to CryptoKitties, there were no NFT standards and Axiom Zen pioneered the ERC-721 standard. With CryptoKitties, each digital cat is an ERC-721 token - which is just a standard for provably rare digital assets, including a set of rules that must be followed to interact with other NFTs and the wider Ethereum ecosystem. This differs from an ERC-20 token which can be created to issue new assets, such as stablecoins or DeFi coins, where the value of each token is the same.

ERC-20 tokens are fungible (in theory), whereas the ERC-721 standard allows the Ethereum chain to recognise transfers and ownership of individual, non-fungible tokens. This means anyone can track the ownership of kitties and see what price it had previously sold at. Actions such as buying, selling or breeding a kitty requires a fee, since these are all performed by Ethereum smart contracts.

The popularity of the blockchain game grew rapidly because of the massive profits some players made from breeding and trading these kitties. CryptoKitties amassed more than 150,000 users in a couple of weeks, and the game was so successful it caused severe congestion on the Ethereum blockchain, which subsequently received a lot of attention from the mainstream media.

Another NFT standard is ERC-1155, which was created by the blockchain-based gaming project Enjin. The ERC-1155 standard differs from the ERC-721 standard, as it can create both fungible and non-fungible tokens. In-game assets can be fungible (e.g., an in-game currencies, such as gold) or non-fungible (e.g., personalised items, such as weapons), so this standard allows developers to create both classes of asset for in-game items.

Between 2018-2019, the NFT ecosystem blossomed with the launch of new projects and the rise of marketplaces such as OpenSea and Rarible. Some of the new projects include the Flow blockchain, which launched its beta mainnet in September 2019 and was created by Dapper Labs (the same people behind CryptoKitties).

Dapper Labs has since partnered with big brands such as MotoGP, NBA, and UFC to create blockchain-based collectibles and games on Flow. Another blockchain that eventually became popular for NFTs called WAX was launched in 2019, which hosts projects such as Alien Worlds, R Planet, and Bitcoin Origins.

In the past couple of years, we've witnessed an explosion of interest in NFTs and more mainstream attention, investment into the NFT sector by big players (such as the Winklevoss twins who launched the digital art and collectibles marketplace Nifty Gateway), the first purely digital artwork sold at a Christie’s auction, and mainstream musicians experimenting with NFTs.

What are the Opportunities for NFTs?

The global collectibles market is estimated to be worth around $370 billion market: NFTs are set to expand this market as well as modernise it, bringing it up to speed with the digital age. The gaming market is reportedly worth around $162 billion worldwide, and with the possibility of in-game items that players can truly own and trade, NFTs are likely to expand this market too with innovative blockchain-based games.

The trend of modernising collectibles in the sports industry is an obvious opportunity for NFTs, already recognised by projects such as F1 Delta Time, NBA Top Shot, and Sorare which have gained a lot of users in a short period of time.

There are also many opportunities for people buying and selling NFTs, playing the games, collecting the NFTs, and so on. For collectors or investors, there's more transparency on pricing, as the blockchain records the price paid for an NFT in an auction or secondary sale, every single time.

An artist can create and sell their own work with NFTs, cutting out intermediaries or brokers. The artist is empowered since they can keep more of their earnings. They can also prove ownership of the artwork, track it every time it is traded (since the blockchain will provide a record of transfers of ownership), and a royalty can be even programmed into the NFT to ensure that a certain percentage of any secondary sales go directly to the artist.

What’s the Most Popular NFT Project?

The most popular NFT project based on all-time sales is built on the Flow blockchain: NBA Top Shot. The digital collectible game has the branding of the most popular basketball league in the world, with over $490 million in all-time sales and more than 229,000 buyers so far:

The NFT project with the second highest all-time sales is CryptoPunks.

The digital collectibles have an all-time sales volume of almost $195 million and more than 2,300 buyers. As shown above, we can see that the top individual NFT sales are all CryptoPunks, with ‘cryptopunk7804’ selling for 4,200 ETH!

There’s a ton of NFT data on Cryptoslam.io and it is one of the best free tools out there for NFT investors. The website shows the rankings for the most popular NFT projects based on sales, buyers, transactions or owners, the largest individual sales, as well as showing live sales and a live marketplace.

Dune Analytics, which is powered by SQL, can be used to produce user-created dashboards that pull data directly from the Ethereum blockchain to provide insights into the NFT market.

Another way to track popular NFT projects is NonFungible.com, which presents data on the number of sales and sales volume in USD for projects based on Ethereum. You can also look at NFTs by subsector on NonFungible, so you can find the most popular Ethereum collectibles, the highest volume art NFTs, or a blockchain-based game with the most sales.

Where Can I Buy NFTs?

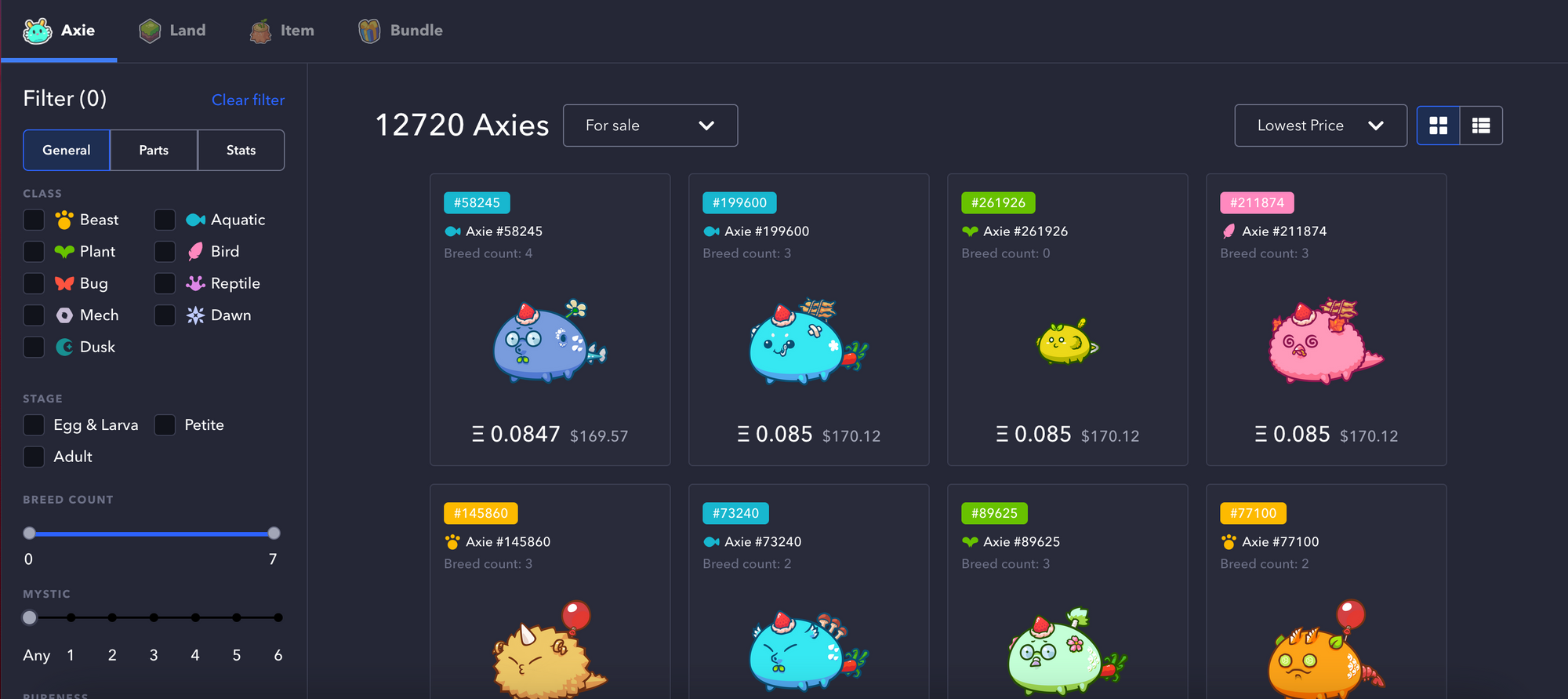

NFTs can be bought and sold on marketplaces such as Rarible, SuperRare, and Nifty Gateway. Some NFT projects, like Axie Infinity, have their own dedicated, in-built marketplaces:

To get started with NFTs on Ethereum, you’ll need MetaMask, an in-browser wallet which can store ETH and all the tokens built on top of it. When navigating to an NFT marketplace, your MetaMask wallet will prompt you to link your account and allow you to buy/sell NFTs within the wallet itself.

Each action, whether it is buying an NFT or putting an asset up for auction, will require a transaction fee which must be paid in ETH. Due to the popularity of the Ethereum network, these transactions can sometimes be expensive, so be sure to check the recommended gas prices before making a transaction.

Some tips on buying, investing or trading NFTs: look for high volume/high transaction activity and find out how scarce different assets are within the game (e.g., Mystic class Axies are the rarest).

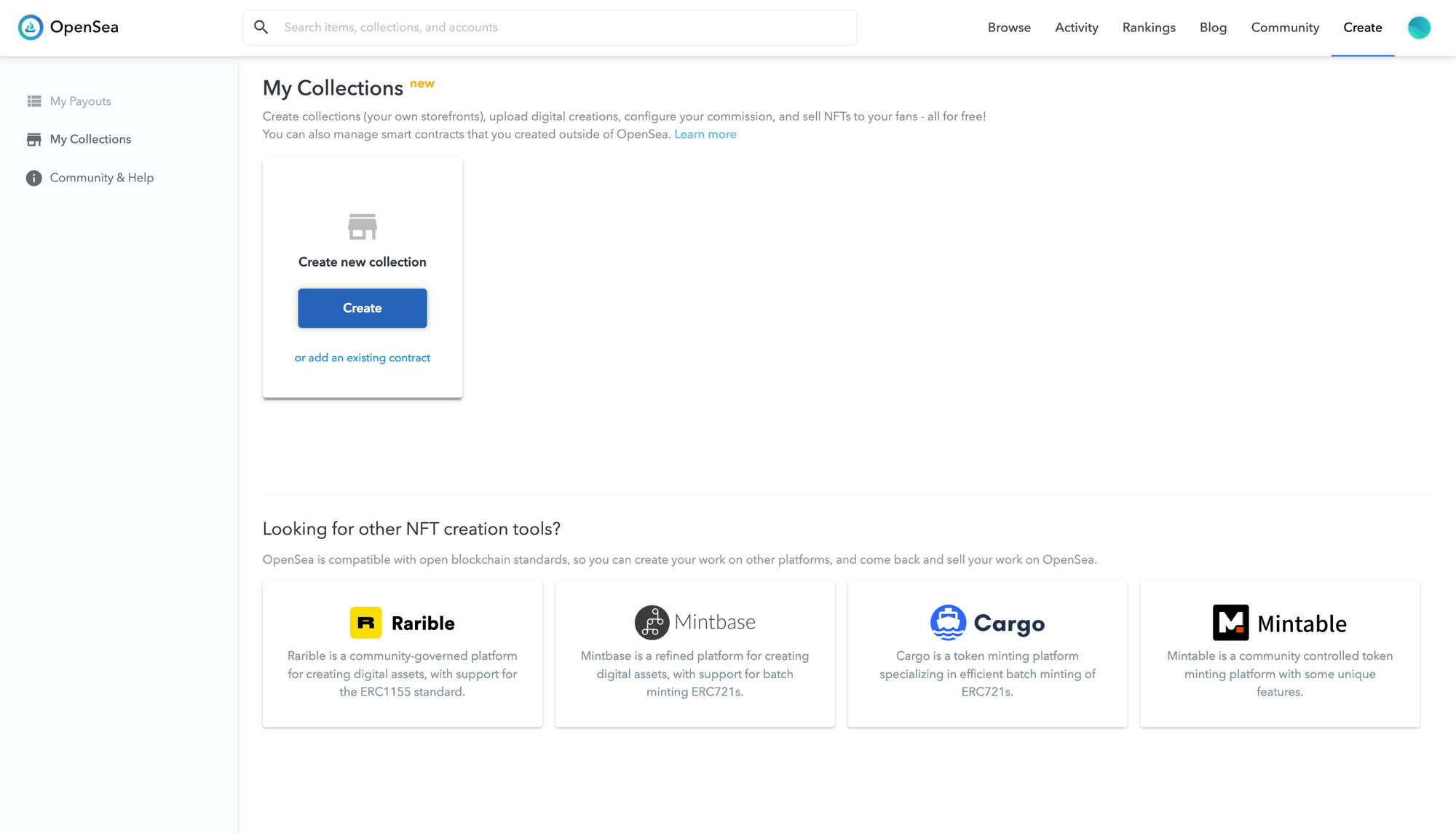

How Can I Create My Own NFTs?

Some platforms allow you to mint your own NFTs, such as OpenSea, Rarible and Mintbase. It will require you to have some ETH in your MetaMask wallet to cover the costs of creating an NFT:

It’s as easy as uploading an image, gif or music track, filling out some details about it, generating the token using an Ethereum smart contract (requires gas to be paid as a transaction fee) and then placing it in a marketplace to find some buyers.

NFTs and Decentralized Finance (DeFi)

An interesting avenue of exploration is how to use NFTs as collateral in decentralized lending protocols. To use an NFT as collateral, it is kept in an escrow contract once the owner is matched with a lender and borrows some funds. Once the debt is repaid, the NFT is released back to the owner.

However, if the borrower doesn't repay the loan, the NFT is transferred to the lender. NFTfi does exactly this with a peer-to-peer model to provide loans and NFTs are used as collateral. Lenders can offer loans for particular NFTs as well.

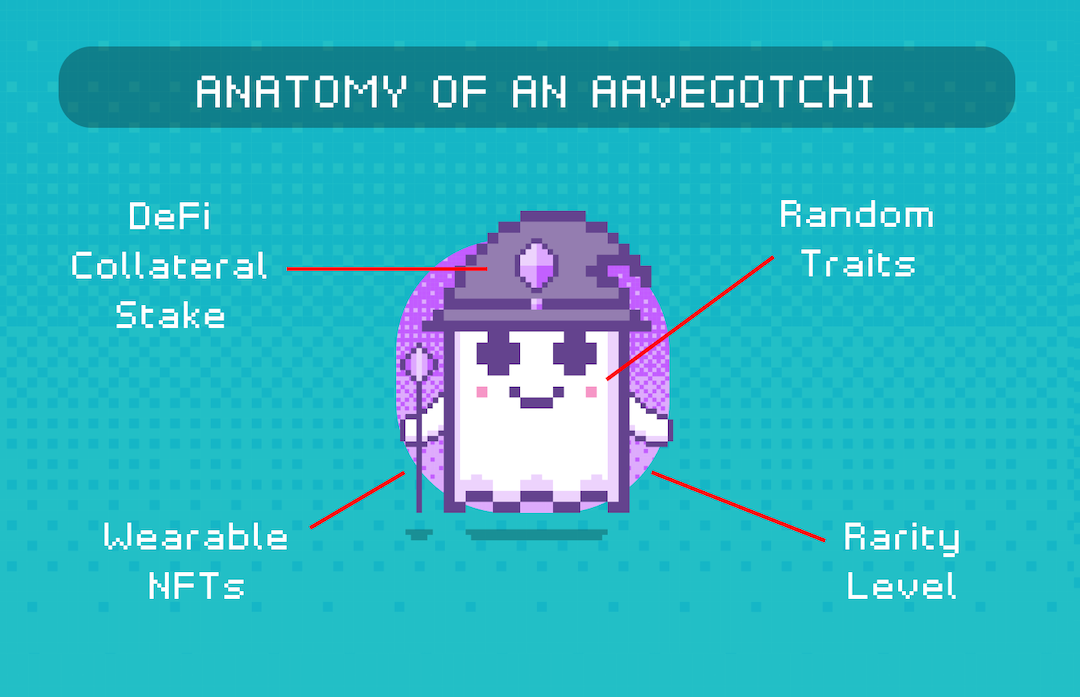

Aavegotchi is another instance of the DeFi-NFT crossover and are Aave's take on NFTs. If you’ve read our DeFi article, we summarized the decentralized lending protocol Aave, and you'll recall that aTokens represent cryptocurrencies locked in the protocol by lenders that have deposited to earn interest.

Aavegotchis are NFTs that are staked with the interest generating aTokens. These digital ghosts also earn value through interacting in the Aavegotchi metaverse as well. Just like other NFTs, such as CryptoPunks or Axies, the rarer your Aavegotchi’s attributes are, the higher its market value will be. The difference here though is, the value of these collectibles can be increased by acquiring wearable NFTs and playing mini-games!

We've provided a brief overview of some of the more popular NFTs in this article. If there's anything you're interested in or would like to read about in more depth, please let us know on Discord or via Twitter.-The Rollbit Team