What is Chainlink and Is It a Good Investment?

In just a few years, the LINK token swiftly climbed the ranks becoming one of the largest cryptocurrencies, capturing value from DeFi.

In this article, we look at the investment case for Chainlink's native LINK token.

What is Chainlink?

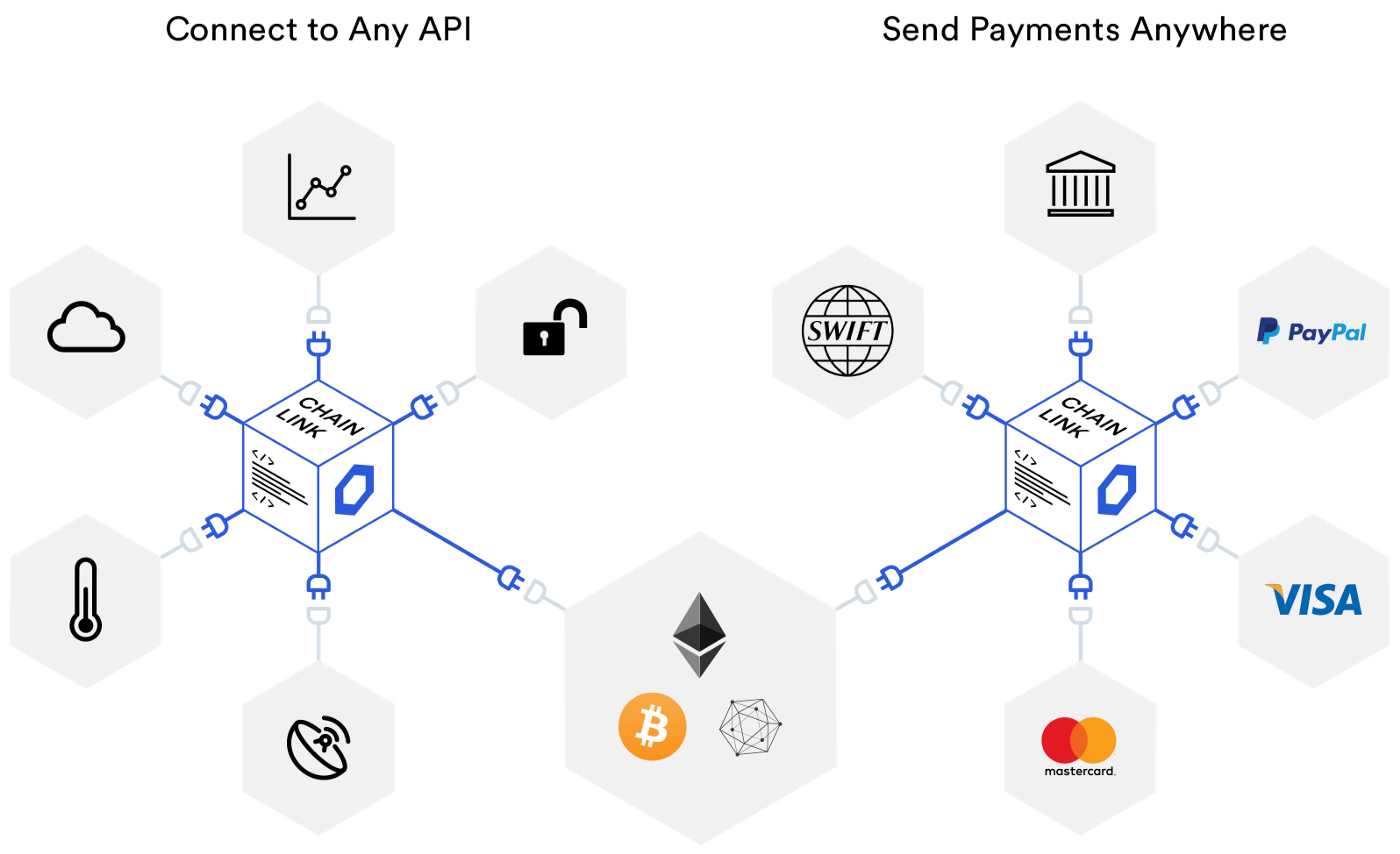

Chainlink is a decentralised network of oracles that enables smart contracts to securely interact with real-world data and services that exist outside of blockchain networks. Since blockchains like Bitcoin or Ethereum cannot access real-world data (known as the 'oracle problem'), Chainlink provides a bridge between smart contracts on the blockchain and external data.

It's important to note that while Chainlink is built on Ethereum, the platform itself is blockchain agnostic meaning that it can be connected to any chain to provide data to other smart contract networks.

Chainlink connects blockchains to any API/data feed and existing payment systems like SWIFT.

While smart contracts on the blockchain are permissionless, transparent and improves efficiency, if a centralised data feed provided the data then it negates the benefits of decentralisation. Because centralised data feeds can be tampered with, they introduce a single point of failure for the decentralised smart contract.

What is a smart contract? A smart contract is a self-executing digital contract with the terms of the agreement written in code.

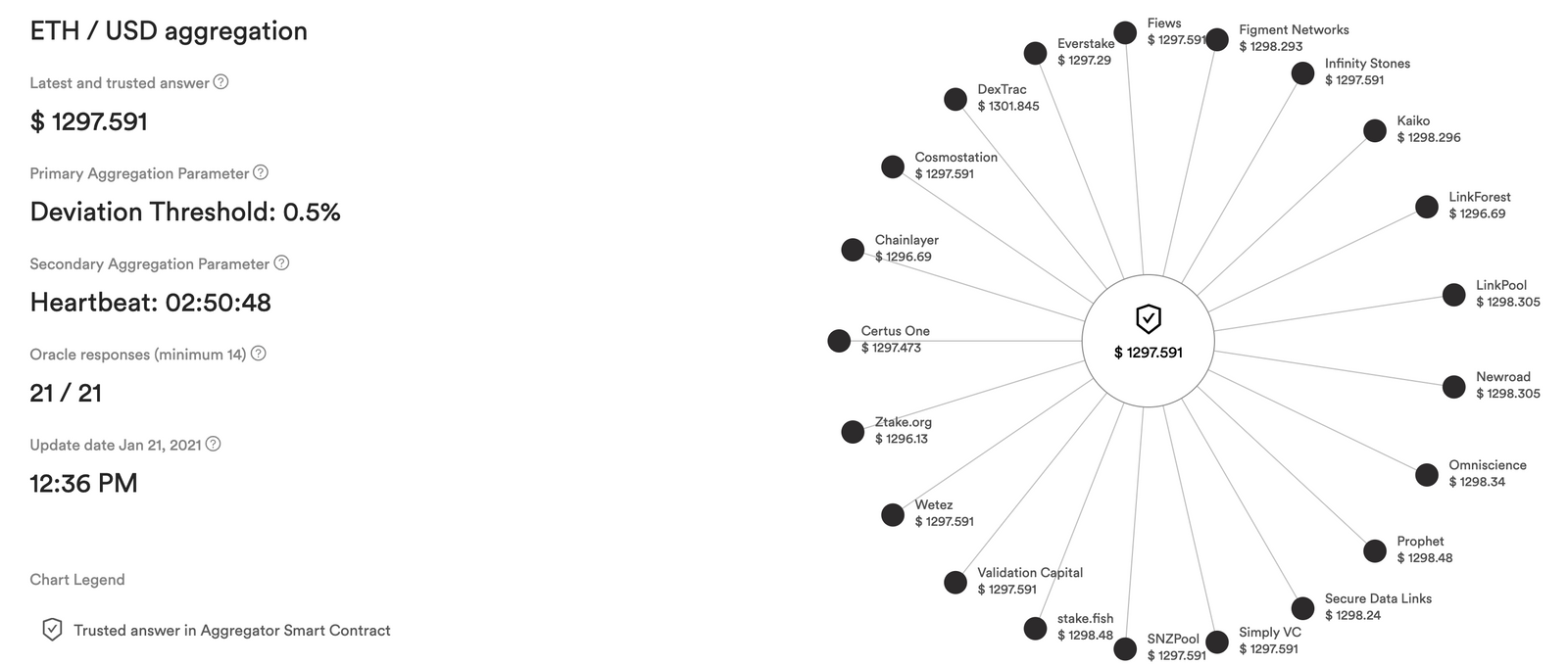

Chainlink addresses this problem by decentralising data feeds so that there are multiple sources providing data inputs for a particular smart contract. The node operators that provide the most accurate data are rewarded while nodes that provide inaccurate data are punished, leading to the creation of a reputation scoring system for data providers.

Take the example of flight insurance, where the insured party receives a payout if their flight is delayed. With centralised insurance there may be a disagreement about whether a payout is due, there’s a lack of transparency and claims are processed manually which can be time-consuming.

However, with a decentralised insurance provider like Etherisc, the policy can be programmed into a smart contract that cannot be tampered with. But blockchains cannot connect to the external data needed to trigger the contract in the event of a delayed flight and there's no point in using a centralised data service as part of a decentralised insurance offering (for the reasons outlined above).

This is where Chainlink's oracles come into play, which enable smart contracts to connect to off-chain data sources. Chainlink's decentralised oracle network gives the insurance smart contract secure and reliable access to flight status data. The individual responses from each node about a flight's status are aggregated into a single data point to mitigate oracle downtime and from any one node becoming a point of failure.

What is LINK?

As the native token of Chainlink, LINK serves a few purposes in the ecosystem. It is an important part of the Chainlink network, since LINK is the only token that can execute smart contracts with the ERC-677 functionality, which allows token transfers to contain a data payload.

LINK is used to reward data feed providers for their data inputs for smart contracts. For instance, a Etherisc flight insurance smart contract may reward the providers of flight data for reacting to their request for whether a flight departed on time. The amount of LINK earned is set through deals with smart contract creators.

The token is also an integral part of the reputation system. The token can also be staked by node operators to provide oracle services, with LINK acting as a form of collateral. The amount of LINK held is one factor determining an oracle's reputation, and with a higher reputation it increasing their chances of earning more from retrieving data for different contract creators.

Oracles also have to put up some LINK as a deposit, which is returned once they complete the task, i.e., retrieving some data. However, if the oracle cannot deliver the requested data, then the contract creators keep the deposit at the end of the contract.

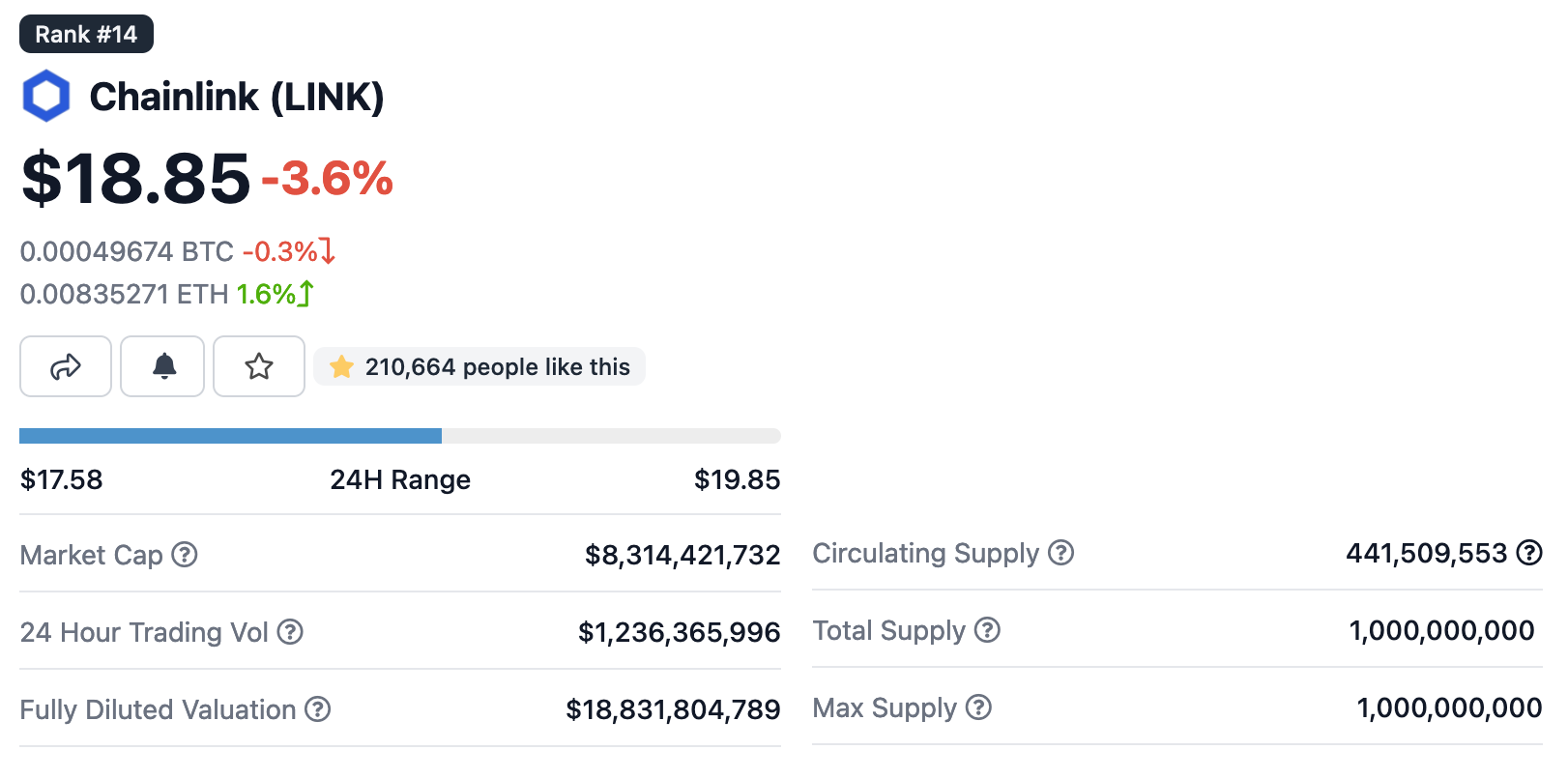

Similar to cryptocurrencies like Bitcoin, the Chainlink protocol ensures that LINK has a fixed supply and there will be only 1 billion tokens circulating. Since LINK has a fixed supply, it is relatively more scarce than other cryptocurrencies without an upper supply limit.

Source: CoinGecko

However, unlike Bitcoin or Ethereum, Chainlink tokens are not created through Proof-of-Work mining which means they are not as widely distributed as these cryptocurrencies. Chainlink raised $32 million in a token sale that took place in September 2017, with 35% of the total supply (350 million LINK) sold to investors. Another 35% of the supply was set aside for node operator rewards and to incentivise participation, while the remaining 30% is held by SmartContract.com, the parent company of Chainlink.

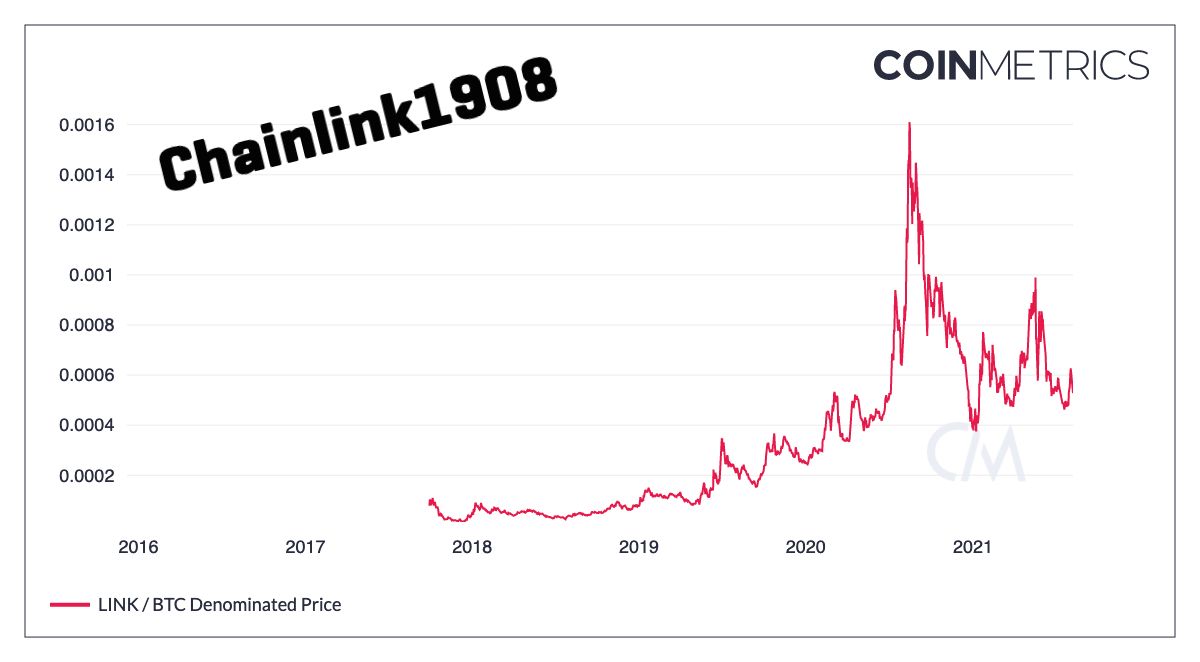

Why Has LINK Outperformed Bitcoin?

Here's a chart of the price of LINK against Bitcoin. Up until mid-2020, LINK had always posted a series of higher lows and higher highs in terms of the price of Bitcoin, meaning that the price of LINK was growing at a faster rate.

Source: CoinMetrics

Then the price of LINK suffered a crash to 0.00040 BTC per token between September 2020 and early 2021 but has recovered somewhat since then. It's also interesting to note that even during the bear market of 2019, the LINK token kept on posting higher highs and was largely unaffected.

The price of LINK is closely related to the demand and supply for oracle services. Two reasons why Chainlink outperformed Bitcoin during this time period: Chainlink's growing role in Decentralised Finance (DeFi) and Non-Fungible Tokens (NFTs) which meant that value was being captured by the LINK token as these sectors grew and required oracle services.

For example, Chainlink provides pricing feeds (such as the ETH-USD exchange rate) for DeFi applications to prevent exploits based on market manipulation and flash loans. The LINK token is also used as collateral in many DeFi applications, adding even more utility. For NFTs, Chainlink introduced the Verifiable Random Function (VRF) in October 2020 which provides a provably fair and verifiable source of randomness for smart contracts.

Source: Chainlink blog

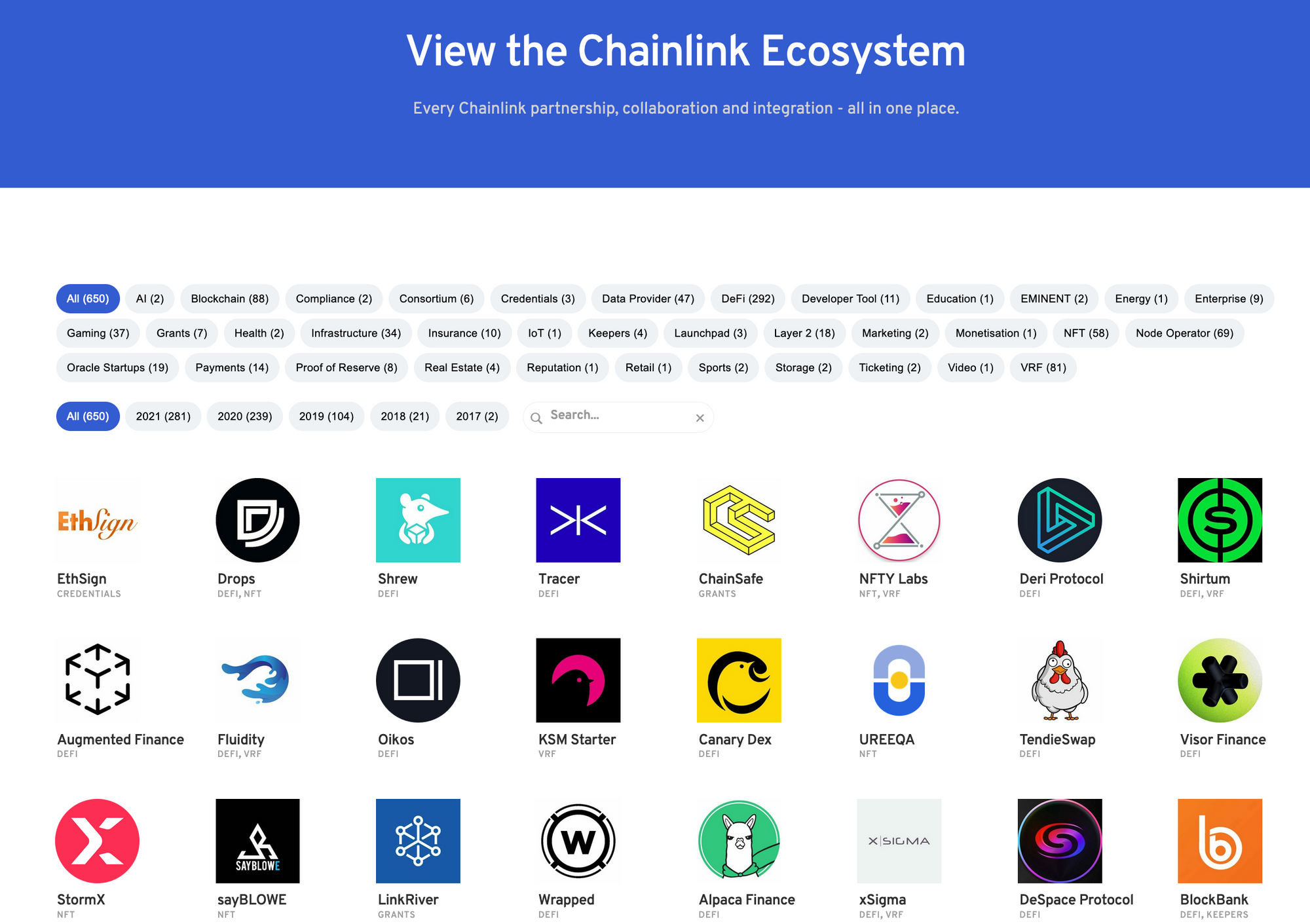

Another reason the LINK token performed so well is because of the fact that Chainlink is blockchain-based middleware. As a result the project has secured a huge number of strategic partnerships (totalling 650 according to chainlinkecosystem.com) which have supported the value of the LINK token and created a social buzz.

Source: chainlinkecosystem

Most decentralised applications will need to utilise tamper-proof, real-world data and as the number of users grow, so will middleware solutions like Chainlink, which have the potential to capture as much value as the underlying protocols of different Dapps such as Ethereum.

In April 2021, the team released the whitepaper for Chainlink 2.0 which will upgrade the network and introduce a new form of staking known as explicit staking. This highly anticipated staking feature could increase demand for the token as it would also positively affect the supply dynamics, locking up tokens and reducing the circulating supply. However, there are some criticisms of the Chainlink 2.0 whitepaper (one of which you can read here).

What are Some of the Risks of Investing in LINK?

One of the biggest risks to LINK holders is centralisation of the supply. A large portion of the token supply (30% equating to 300 million tokens) was allocated to Chainlink's parent company, SmartContract.com. The fraction of supply that is allocated to node operators as incentives is also controlled by the Chainlink team (35% equating to 350 million LINK).

If the team sells a large percentage of these tokens, then this could drive the price lower depending on how many tokens are released. For instance, a report from Trustnodes during August 2020 claimed that the Chainlink team were selling tokens causing the price of LINK to drop from $20 to a low of $7.28 in September 2020.

The following Chainlink addresses are controlled by the team and are worth monitoring if you are are invested in (or are trading) LINK:

- 0x98c63b7b319dfbdf3d811530f2ab9dfe4983af9d

- 0x75398564ce69b7498da10a11ab06fd8ff549001c

- 0xe0362f7445e3203a496f6f8b3d51cbb413b69be2

- 0xbe6977e08d4479c0a6777539ae0e8fa27be4e9d6

- 0xf37c348b7d19b17b29cd5cfa64cfa48e2d6eb8db

- 0xdad22a85ef8310ef582b70e4051e543f3153e11f

Critics of Chainlink also point out that the use of the LINK token isn’t necessary for the decentralised oracle network. For example, another token could be used instead (such as ETH) by wrapping it into the protocol. However, LINK has already gained a strong network effect, making it unlikely that the token will be replaced by ETH or another crypto-asset.

Another risk when investing in LINK is that there’s competition from other oracle networks such as Band protocol, DIA, and the Kylin network. However, Chainlink has a first-mover advantage as the oracle standard and a head start compared to other networks, so there’s a small likelihood that any of its competitors will overtake it.

In summary, if you think the demand for oracle services provided by Chainlink will increase over the long-term in tandem with the growth of DeFi and NFTs, then LINK may be worthy of investment. However, if you think Chainlink will be surpassed by another oracle network or are uncomfortable with the centralisation of the token's supply, then you could short LINK to profit from a decline in the price.

No matter what you think about LINK, you can go long or short with up to x100 leverage on Rollbit. If you're bullish and think the price will appreciate then you can go long on the token. If you're bearish and think the network is overvalued, you can go short.What do you think about the potential of LINK? Let us know on Discord or via Twitter!

-The Rollbit Team