The Crypto Pulse: December 13th

Rollbit's weekly analysis and review of the news in Bitcoin, Ethereum, NFTs and cryptocurrency markets.

Rollbit's weekly analysis and review of the news in Bitcoin, Ethereum, NFTs and cryptocurrency markets.

News 📰

SushiSwap's CTO Resigns Amid Infighting

Joseph Delong, the CTO of SushiSwap, has resigned from the decentralised exchange which comes amid growing tension within the SushiSwap team.

Former team members claimed that the key developer who took over after Chef Nomi, 0xMaki, was forced out of the project. At the time of his departure, 0xMaki's post indicated he himself was the driving force behind the decision, but team members claim this wasn't the case.

In the interest of the Sushi Community I am resigning as CTO effective immediately. I very much enjoyed the things that we built together and will look back positively on this moment. pic.twitter.com/7pZsQuPgup

— Joseph Delong (@josephdelong) December 8, 2021

Delong's exit comes after he threatened to quit if the community failed to support the core team and he tweeted on Wednesday, "The chaos that is occurring now is unlikely to result in a resolution that will leave the DAO as much more of a shadow than it once was without a radical structural transformation."

SUSHI has bounced from the December 11th lows near $4.95 and is currently trading at $6.13. The cryptocurrency has risen today following news that Daniele Sestagalli, a top application developer on layer 1 blockchain Avalanche, proposed joining the platform in a post on the project’s governance forum.

Get exposure to SUSHI via Rollbit's Crypto Portfolio feature.

Solana Validators, Engineers Grapple With Blockchain Slowdown on Public Call

The Solana blockchain experienced severe congestion on the morning of December 9th, with the network processing less than 500 transactions per second, as compared to the usual 2,000 transactions per second.

The #Solana validator network is experiencing issues this morning. TPS issues as the network works to process txn requests.

— GenesysGo.sol - Shadowy Super Coder DAO (@GenesysGo) December 9, 2021

Remember, this is blockchain 😊 If your txn ID went through then it’s not lost, just pending. Growing pains is all! pic.twitter.com/2Zfagq092M

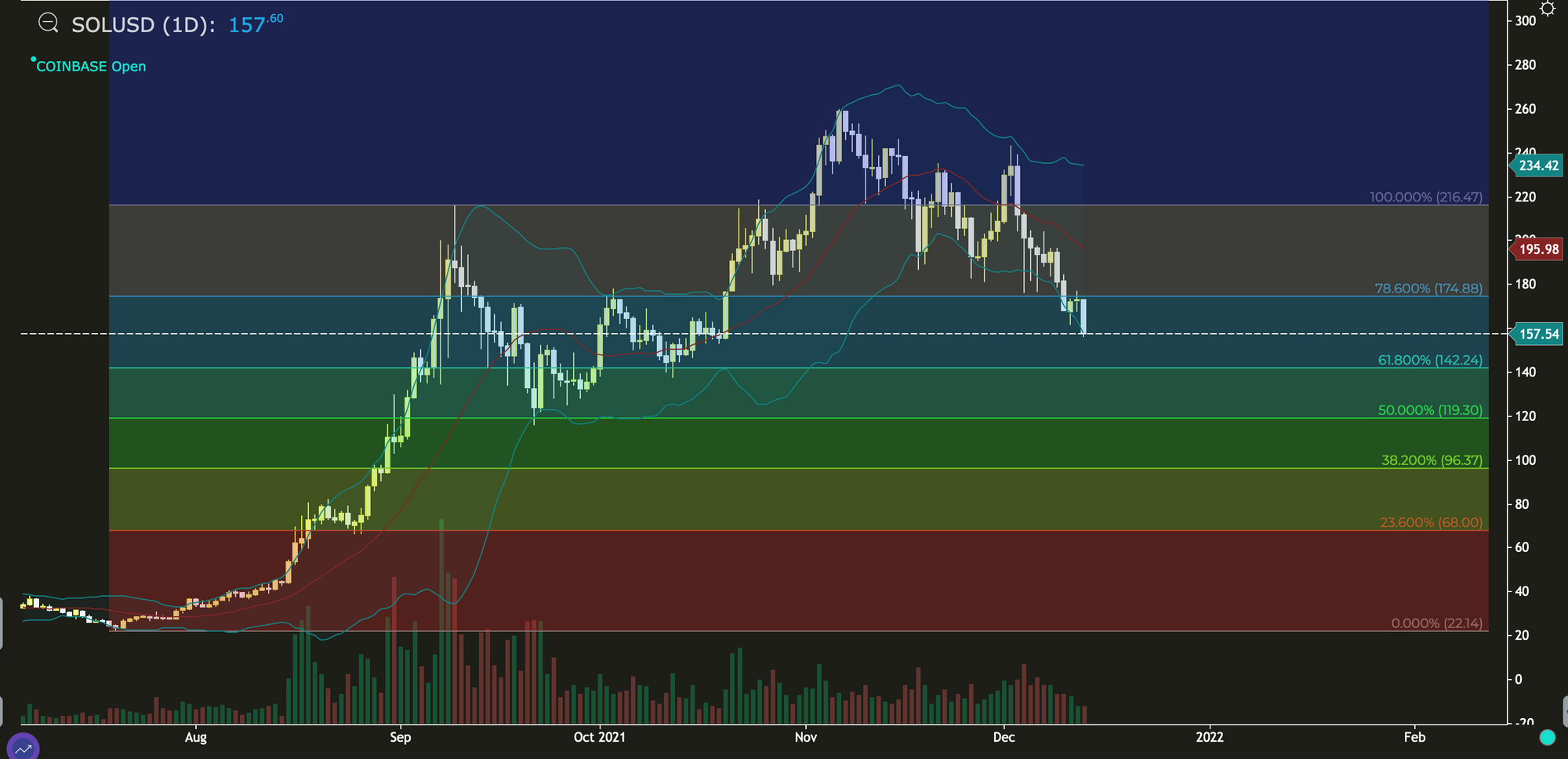

By the evening of December 9th, the issues had mostly been resolved but the price of SOL had dropped almost 7% on the day and has continued to fall, trading around $157 at the time of writing (versus the $180-$190 range on December 8th).

A Rare CryptoPunk has Sold at a Record $10.2 Million

On December 9th, someone purchased a rare Ape CryptoPunk for 2,500 ETH! While it's not the most expensive Punk ever sold, CryptoPunk #4156 is the most valuable Punk sold on the Larva Labs marketplace, which predates popular NFT marketplaces like OpenSea.

The last sale for CryptoPunk #4156 prior to the recent one was nine months ago, where the NFT sold for 650 ETH. Therefore, the seller has netted a profit of 1,950 ETH from last week's sale.

Polygon Acquires ZK-rollups Startup Mir Protocol for $400 Million

Polygon network made another acquisition in the ZK-rollups space buying Mir Protocol for $400 million. Mir is an Ethereum scaling startup utilising zero-knowledge proof technology, which Polygon says is the fastest ZK-proof technology, known as 'plonky2'.

Mihailo Bjelic, co-founder of Polygon, said, "It is a great piece of engineering. Plonky2 can generate recursive proofs in an incredible 170 milliseconds on a laptop. Most importantly, plonky2 is practical to use on Ethereum, with 45kb proofs in size-optimized mode."

Mir has now rebranded to Polygon Zero and their ZK-rollup scaling solution will be ready sometime next year.

Bored Apes’ Generous Copyright Approach Besting Stricter CryptoPunks

With the floor price of Bored Ape Yacht Club (BAYC) rising and not far behind that of CryptoPunks, some believe it’s because of the creator of BAYC giving holders the intellectual property rights to the underlying artwork of the NFT collection.

While Ape holders can profit from the art and make derivatives, the same is not true for CryptoPunks. CryptoPunk creators, Larva Labs, retain the rights to reproduce Punks and profit off their imagery commercially.

Other News

- Reddit looks to expand Ethereum cryptocurrency rewards to more communities,

- Chainalysis launches support for Bitcoin's Lightning Network,

- Bitcoin touches a new milestone with 90% of total supply mined,

- The FOMC meeting on December 15th could impact cryptocurrency markets,

- This week's staking rewards for Rollbit's NFT marketplace can be claimed on Thursday, December 16th at 19:00 UTC!

Market Analysis 📈📉

7-day Price Change

- BTC: -3.9%

- ETH: -9.1%

- BNB: -5.1%

- SOL: -20.0%

- ADA: -10.1%

- XRP: -0.9%

- DOT: -6.2%

- DOGE: -7.8%

- SHIB: -6.6%

- MATIC: -10.6%

- LTC: -5.4%

- TRX: +2.6%

- LINK: -7.5%

Data as of December 13th, 16:00 UTC

Let's look at the Bitcoin chart.

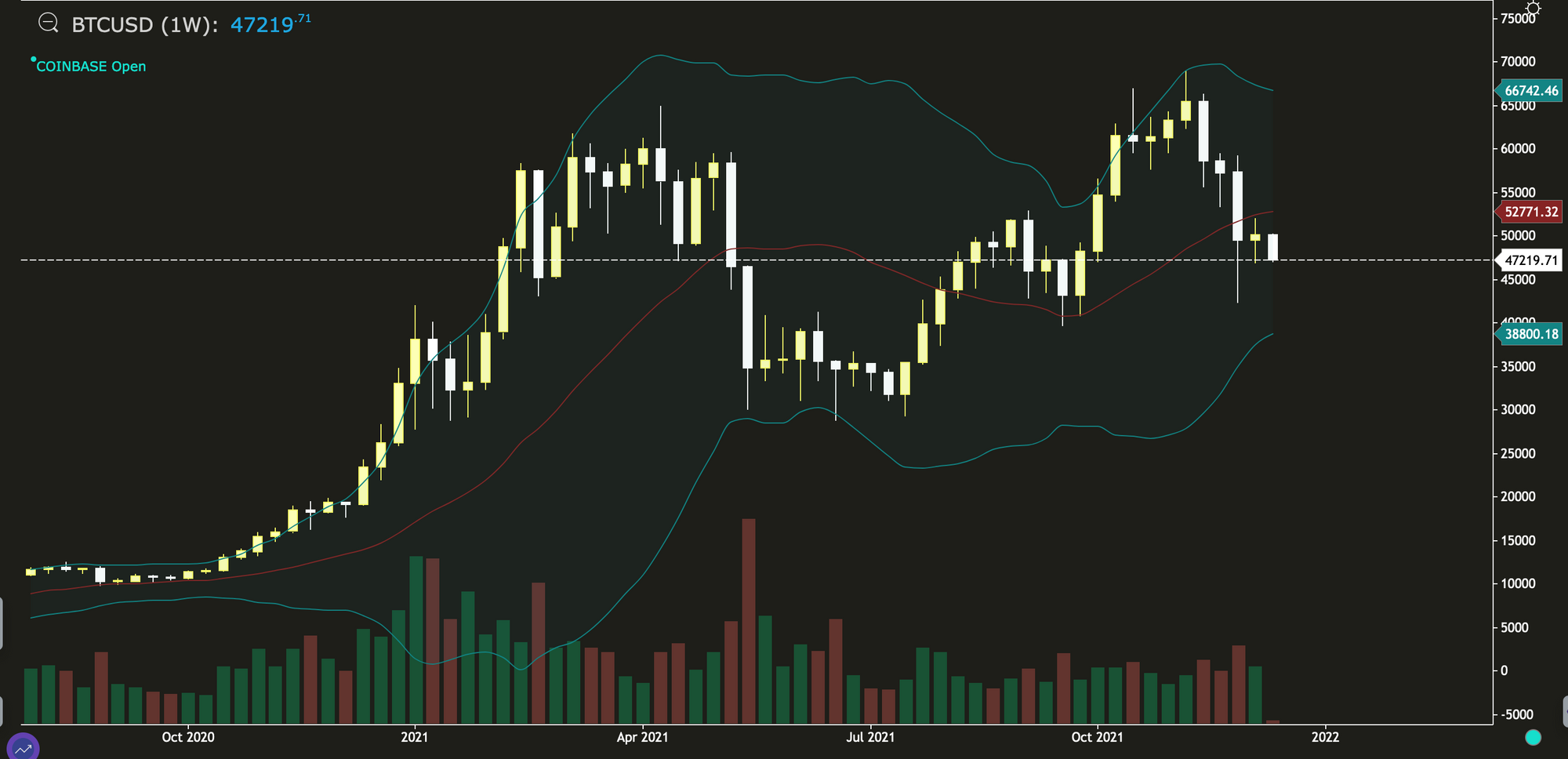

The weekly chart below shows that BTC tried to move back above the middle Bollinger band, but failed and remains below this important level. The middle band now lies at $52,802 and we'd want a weekly close above this level this week for a bullish outlook.

With the price now below the middle band, there's a strong likelihood the market could trend towards the lower Bollinger band over the long term (currently at $38,875), which would provide a buying opportunity.

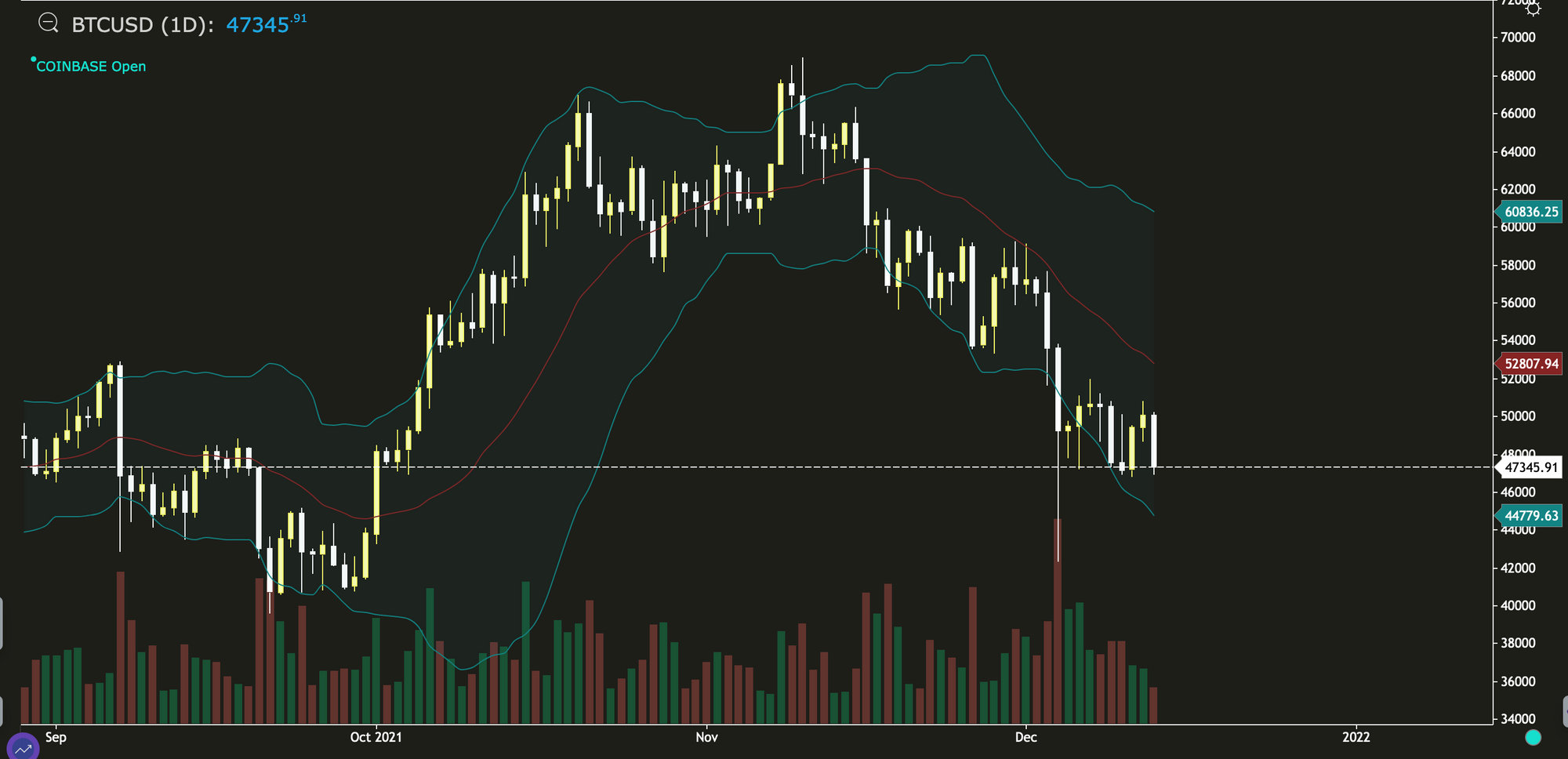

The daily chart for BTC-USD below shows the lower Bollinger band is currently at $44,779, which should provide a buying opportunity for bulls.

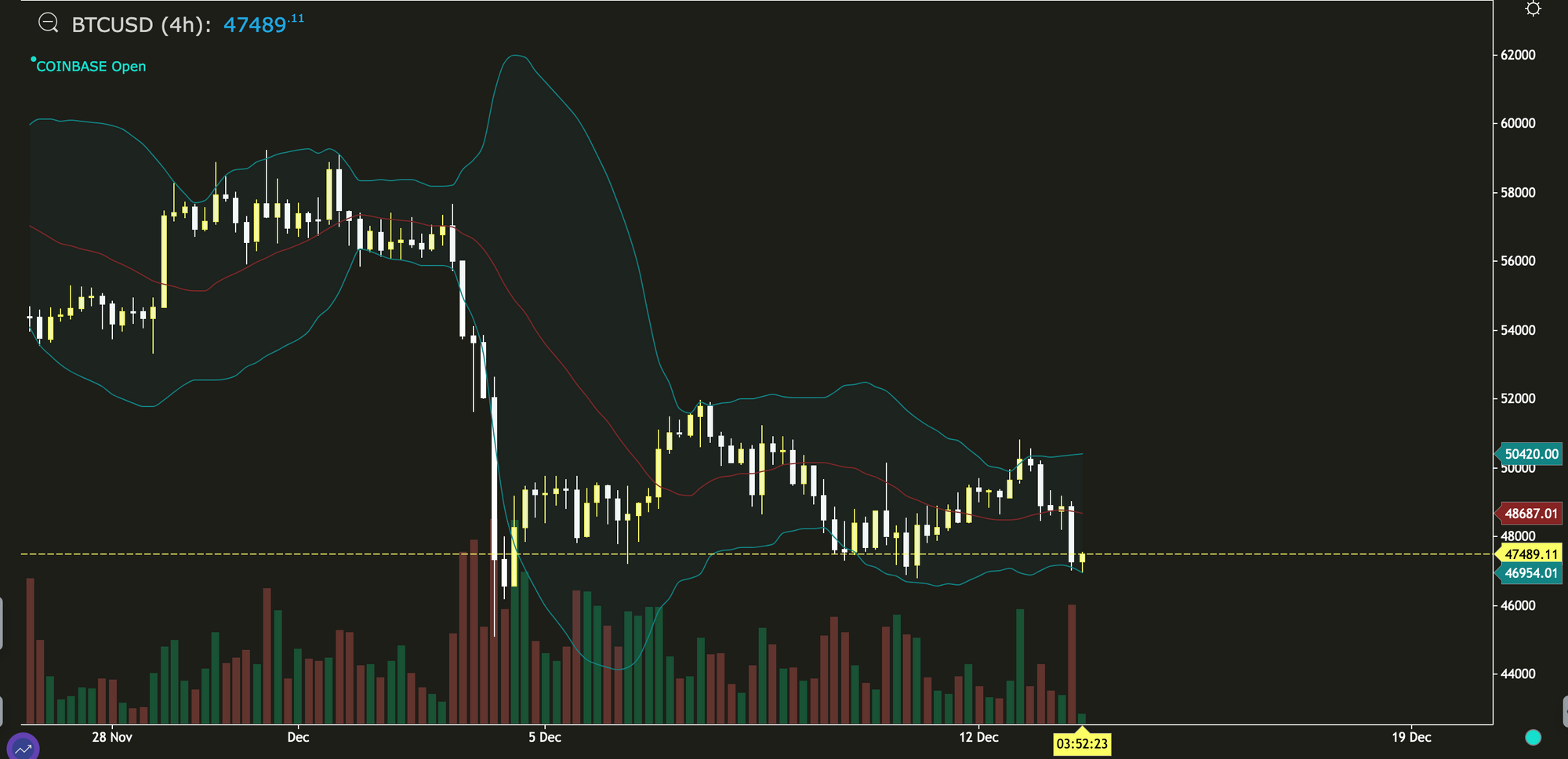

On the 4-hour chart, BTC-USD has already tapped the lower Bollinger band at $46,954, suggesting the market may see a short-term bounce. The middle band lies at $48,687, serving as an initial target for long positions.

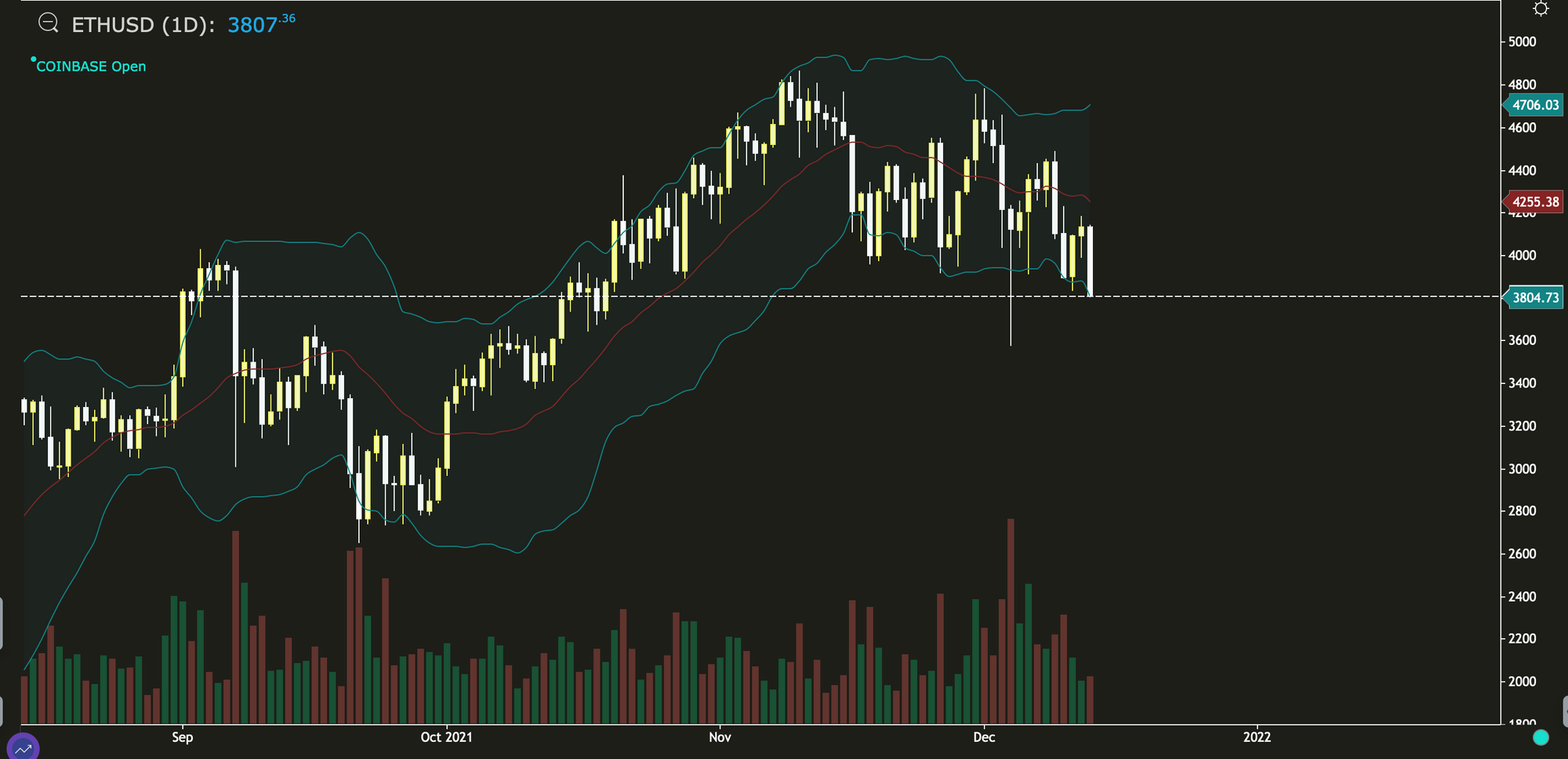

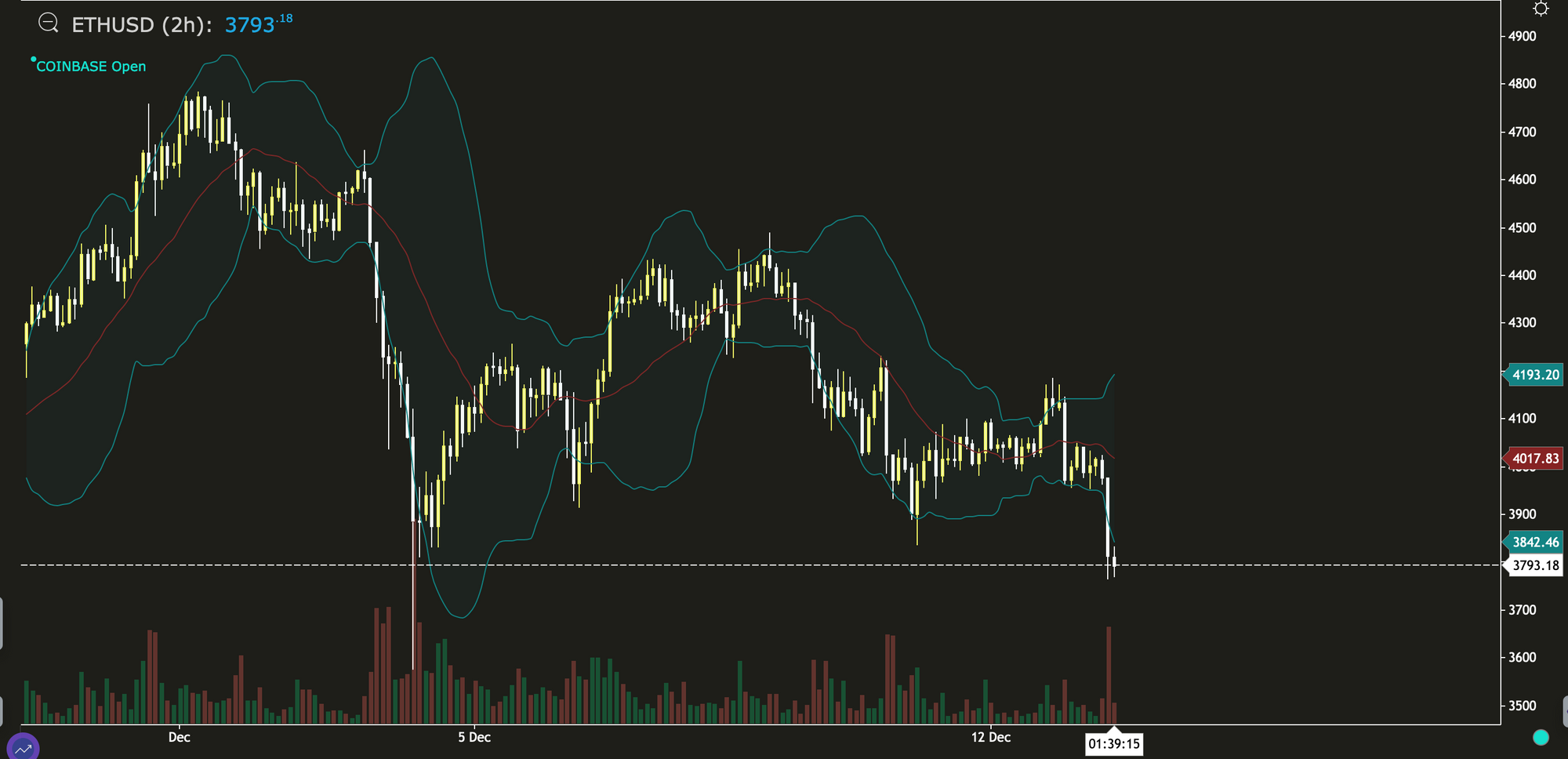

Moving onto Ethereum, the weekly chart below shows that ETH-USD is approaching the middle Bollinger band near $3,777. Therefore, traders will want to monitor this level and see if we get a weekly close below the middle band. If a close below the middle band materialises at the end of the week, it will suggest further losses in the weeks ahead.

The daily chart for ETH shows that the second largest cryptocurrency is testing the lower band at $3,807, with the current daily candle engulfing the past two days of gains. If bulls cannot push the price higher before today’s close, we could see further downside and a push towards the December 4th low below $3,600.

The 4-hour chart shows that the price of Ether is tagging along the lower band and we'd like to see a bullish candle with high volume to highlight a bottom in the current downward move. The width of the bands is not relatively high, suggesting there's still room for more downside.

Solana's SOL token suffered last week and experienced a decline of around 20% over the past 7 days. The next support indicated by Fibonacci analysis lies at $142.24 and could mark a turnaround in the price of SOL. Another support is also found further down at $119.30, near the September low.

Have a great week!

-The Rollbit team