What is Solana (SOL) and Is It a Good Investment?

In this short guide, we'll assess Solana's native asset SOL as an investment.

In this short guide, we'll assess Solana's native asset SOL as an investment.

What is Solana?

Solana is a platform for decentralised applications (or Dapps) that focuses on scalability, competing with other smart contract blockchains such as Ethereum, Cardano and others.

The blockchain project was founded by a group of people working for Qualcomm and was named after Solana Beach (shown below), which is north of Qualcomm's headquarters in San Diego. Individuals from other technology firms like Apple, Dropbox, Intel and Google have also contributed to the development of the Solana blockchain.

Solana Beach, Photo by Leosprspctive on Unsplash

Anatoly Yakaovenko, the founder of Solana, was employed by Qualcomm for 12 years, led the development of operating systems and was responsible for finding a way to maximise the amount of information pushed through a tiny amount of space.

In November 2017, the Solana team released their whitepaper outlining this new blockchain, which reconfigured everything from scratch to overcome a major problem with both Proof-of-Work and Proof-of-Stake blockchains: scalability.

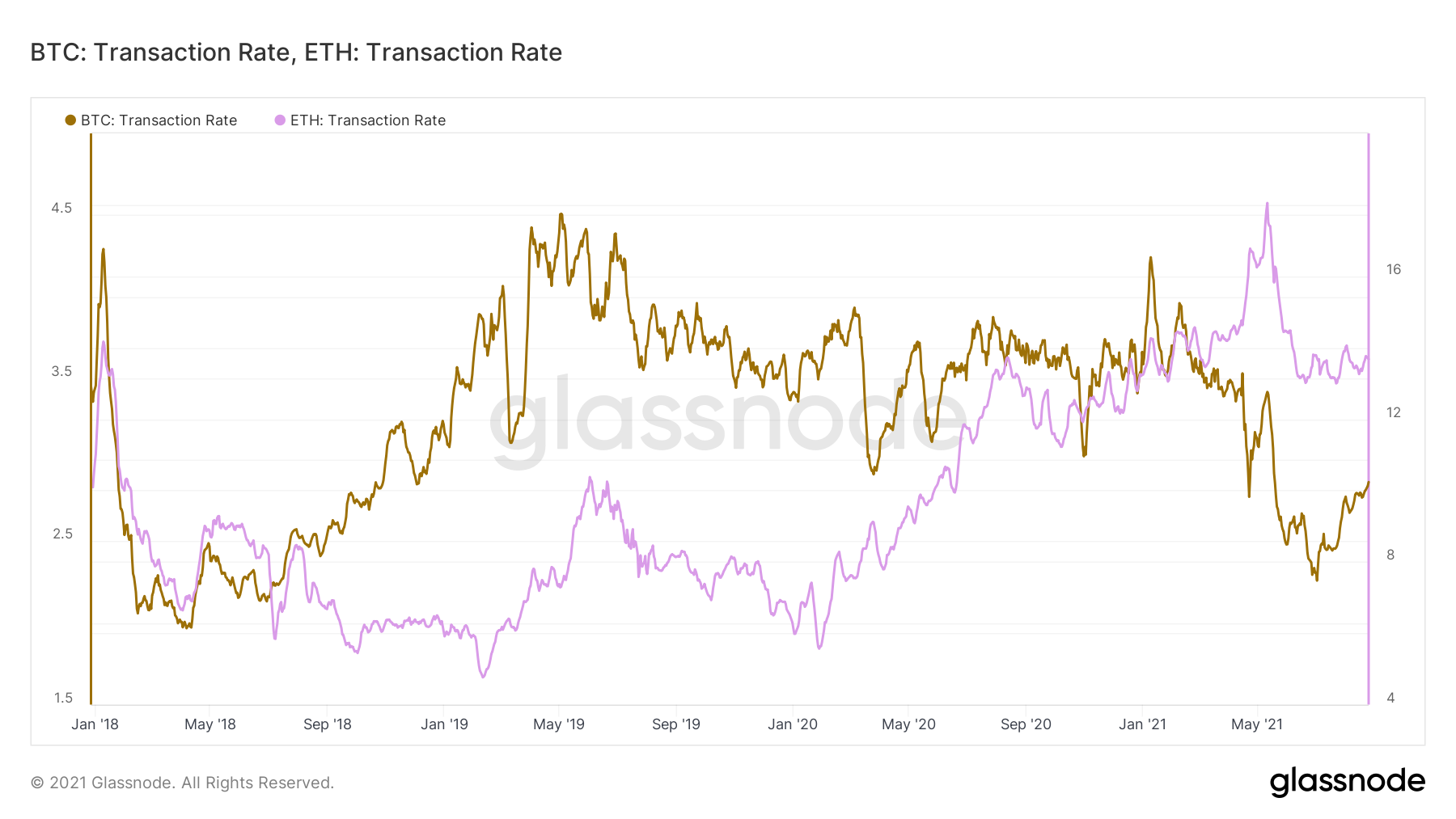

The problem with existing blockchains is low throughput. For example, Bitcoin can only handle a maximum of 7 transactions per second, while Ethereum can process a maximum of 17 transactions per second.

Because of the way Solana has been architectured, it has much faster settlement times with the ability to support 50,000 to 65,000 transactions per second - and a theoretical upper limit of 710,000 transactions per second!

For comparison, the Nasdaq exchange is capable of 500,000 transactions per second, while Visa does around 65,000 transactions per second. This means that if Solana was running at full capacity, its blockchain could support both networks on its Layer 1, something that Ethereum or any other blockchain cannot do without resorting to Sharding or relying on Layer 2 technologies to take the load.

But how is Solana able to process a vast number of transactions compared to existing Layer 1 chains like Ethereum? To synchronise a decentralised system, the Solana team introduced a breakthrough known as Proof-of-History.

What is Proof-of-History?

Solana’s major innovation is the creation of a trustless clock, which solves the problem of synchronising a decentralised system and, in turn, provides enhanced scalability. Simply put, Solana’s blockchain has an in-built clock which allows Solana nodes to order transactions based on the internal timestamps and push loads of transactions through each block.

Photo by Benjamin Rascoe / Unsplash

This novel timestamp system is called Proof-of-History, which enables transactions to be ordered automatically and results in faster transaction speeds.

Proof-of-History (which is not a consensus mechanism) involves adding a verifiable delay function to the SHA-256 algorithm so that all transactions on Solana are time-stamped. Validator nodes on the network can organise transaction records without having to wait for other nodes to validate this data and effectively prevent bots or validators from controlling the order of transactions.

For Bitcoin, each block is added to the chain every 10 minutes on average and 6 confirmations are necessary for a transaction to be considered irreversible. However, instead of each tick on the clock being ~10 minutes, for Solana’s internal clock, each tick is 400 milliseconds (0.40 seconds).

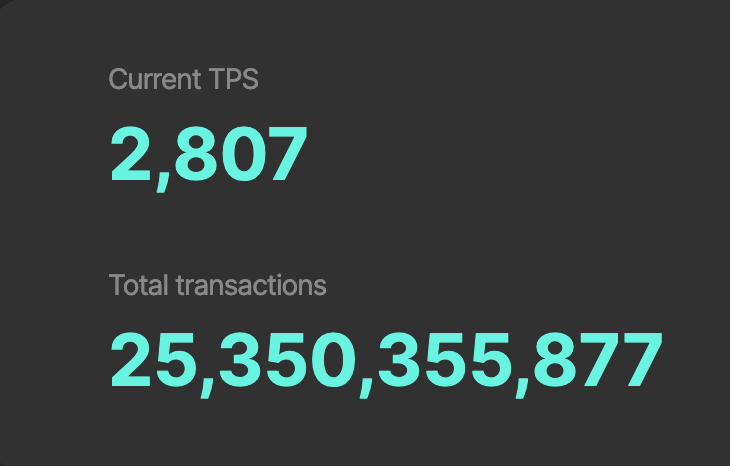

Since blocks are produced every 0.40 seconds and, along with implementing a trustless clock to synchronise the system, the number of transactions per second is currently much higher than any other blockchain. Transactions on average cost a tiny $0.00025 because of the greater scalability, making it more accessible and cheaper than its competitors.

Source: Solana Beach

Proof-of-History is just one major innovation Solana has brought to the table. There are 7 other key technologies that have complemented Proof-of-History to enable greater scalability, which you can read about in more detail here.

What is SOL?

The native cryptocurrency of Solana is SOL, which is used to execute custom programs, used to pay for transaction fees (which are burned) and also to reward Solana network participants.

The SOL token was first distributed across five different rounds, beginning in Q1 2018, four of which were private sales taking place between March 2018 and February 2020. Investors from the public could invest in SOL through CoinList during March 2020 via a Dutch auction, which sold out in just 6 hours at a closing price of $0.22.

A Proof-of-Stake consensus algorithm, known as Tower BFT, is used to help secure the network by using a voting and reputation system to validate transactions and distribute newly minted SOL tokens. Users can stake their SOL directly on the network or delegate their holdings to an active validator to help secure the network.

There's no minimum stake required in contrast to other networks which have much higher barriers to entry (for example, the 32 ETH required to become a validator on Ethereum 2.0 is worth close to $100,000). Rewards are paid out in SOL to stakers proportional to the amount they've staked.

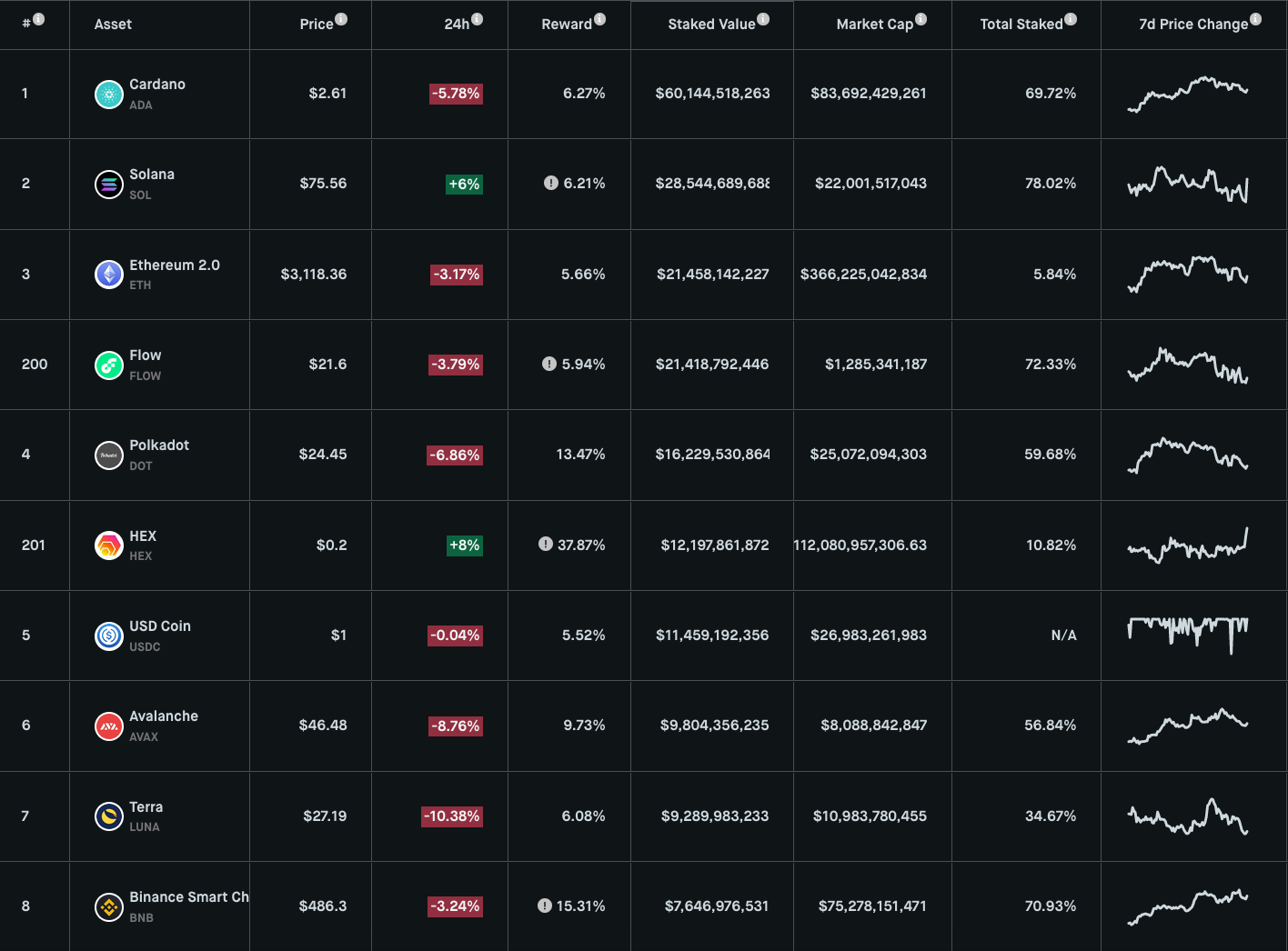

At the time of writing, Solana has the second highest staked value out of all Proof-of-Stake blockchains. With such a high staking ratio, this has benefitted the price of SOL as this portion of supply is effectively taken out of circulation until it is unstaked.

SOL is an inflationary cryptocurrency, meaning there's no limit to the total supply, but the rate of inflation decreases over time. The supply of SOL was growing at a rate of 0.10% per year with newly minted tokens going to stakers and validators until February 2021, when a permanent inflation rate of 8% was introduced.

However, the inflation rate will decrease by 15% per year until it eventually reaches an annual rate of 1.5%, which is expected to happen by 2031 and at which point it will stay fixed.

The Rapid Growth of Solana's Ecosystem

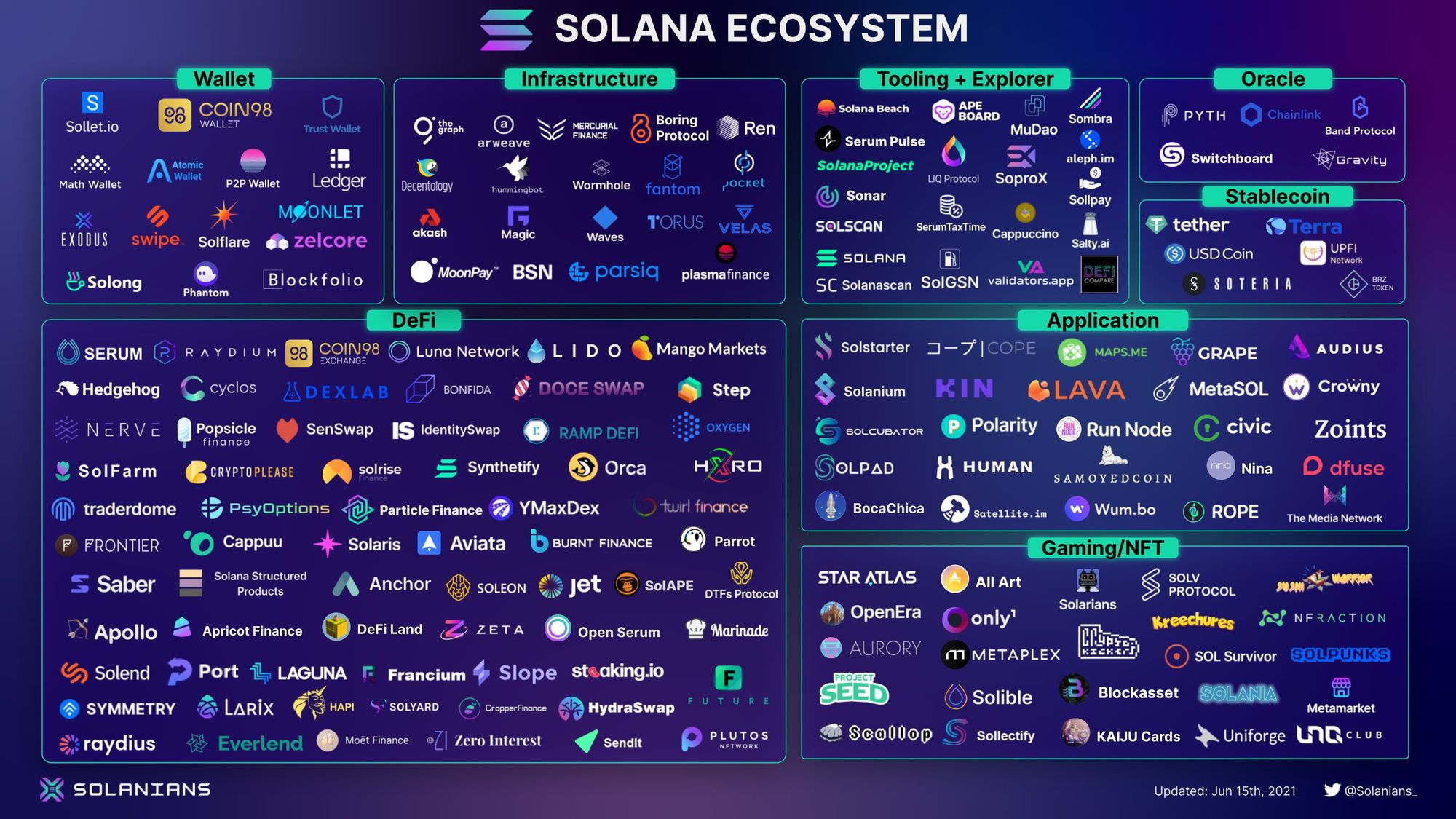

Along with the high number of tokens staked, another major reason SOL has shown an impressive price performance (displayed below) is because of the rapid growth in Solana's ecosystem during 2021, which has so far attracted over 300 projects.

With more and more mainnet releases offering genuine products using Solana, this has attracted more users and increased the value of the SOL token. Three key areas where the blockchain has seen increased adoption:

- Stablecoins: the USD Coin (USDC) launched on Solana in January 2021 and around $1.2 billion USDC has been issued so far. This was followed by USD Tether (USDT) which launched on Solana in March 2021,

- DeFi: many DeFi applications have been launched on Solana, including savings protocol Anchor as well as lending & borrowing protocols like Apricot Finance, Solaris & Solend,

- NFTs: Solana boasts a growing NFT ecosystem with projects like Ape Shit Social Club, Solanimals, Solarians (the first NFT project on Solana), Solpunks (Solana's version of CryptoPunks), the Solanart marketplace and many more.

What Does the Future Hold for Solana?

Solana may very well have the potential to overtake other smart contract platforms since it is the fastest and most scalable Layer 1 blockchain in the market. With a current network valuation of about $33 billion, there's potential for the price of SOL to increase massively in the future if current adoption trends continue.

While Solana is valued at $33 billion, Cardano and Ethereum are worth $90.7 billion and $415.4 billion, respectively. In an optimistic scenario where Solana takes market share from the two leading smart contract chains, the price could rise close to 2.7x-12.6x over the long term, which would suggest a value of around $300-$1,460 for a single SOL token.

However, it's worth keeping in mind that Solana is still highly experimental and there could be some hiccups along the way with the blockchain still in the mainnet beta phase. Also, the total value locked and the developer community does not yet come close to Ethereum. But as time goes on and Solana becomes battle tested, it's likely that it will cement its place in the top 10 coins by market cap and has a decent chance of rising to even higher ranks.

What do you think about the potential of Solana's SOL? Do you think it can become the leading smart contract platform? Let us know via Discord or on Twitter!

-The Rollbit Team