The Crypto Pulse September 20th

Rollbit's weekly analysis and review of the news in Bitcoin, Ethereum and cryptocurrency markets.

Rollbit's weekly analysis and review of the news in Bitcoin, Ethereum and cryptocurrency markets.

News 📰

Fidelity Pushed for Bitcoin ETF Approval in Private SEC Meeting

On September 15th, news broke that Fidelity Investment had urged the Securities and Exchange Commission to approve its Bitcoin exchange-traded fund (ETF) in a private meeting.

The investment firm laid out the reasons why it's now time for a Bitcoin ETF to the American financial regulator, highlighting the increased investor appetite for digital assets and positive fundamentals such as growth in the number of bitcoin holders.

However, the US regulator has taken a cautious approach, with concerns around the lack of regulation and potential for market manipulation. None of the Bitcoin ETF proposals put forward so far have been given the go ahead by the SEC.

Solana Mainnet Back Online After Day in the Dark

Solana's network crashed on September 14th, where the blockchain experienced an outage for over 17 hours as the mainnet beta hit a record number of transactions per second of 400,000.

2/ This forking led to excessive memory consumption, causing some nodes to go offline. Engineers across the ecosystem attempted to stabilize the network, but were unsuccessful.

— Solana Status (@SolanaStatus) September 14, 2021

The price of SOL reached a one-week low of ~$142 on the negative news on September 14th and then saw another fresh low of $134 three days later, before jumping back up to $170 on September 18th.

The Solana validator community successfully completed a restart of Mainnet Beta after an upgrade to 1.6.25. Dapps, block explorers, and supporting systems will recover over the next several hours, at which point full functionality should be restored.

— Solana Status (@SolanaStatus) September 15, 2021

By September 15th, the Solana validator community managed to successfully restart the mainnet beta and eventually restored the network to full functionality. However, it seems that the event still lingers with the downward trend continuing this week, with SOL currently trading around $139/$140.

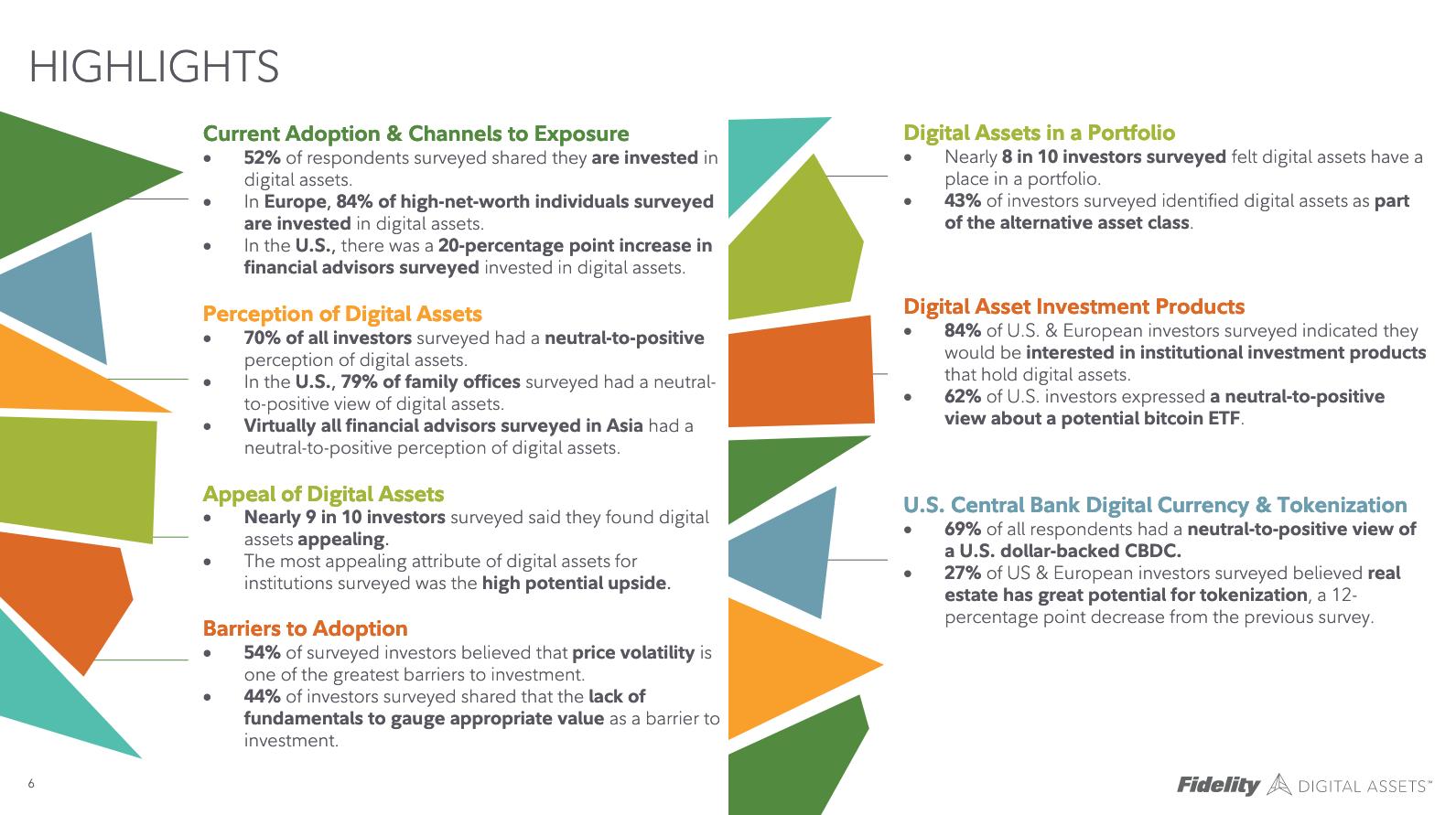

Fidelity Digital Assets Finds 90% of Surveyed Investors Find Digital Assets Appealing

Fidelity Digital Assets surveyed 1,100 investors across the globe which found that 90% of the respondents found digital assets appealing, particularly because of their "high potential upside".

Just over half of the survey's participants stated that they already own digital assets such as Bitcoin and Ethereum, while a large majority of the surveyed investors from Asia and Europe plan to invest in cryptocurrencies in the future. The full results can be found here.

Polychain and Three Arrows Capital Lead $230 Million Investment in Avalanche

On September 16th, Avalanche announced an investment of $230 to broaden Decentralised Finance (DeFi) activity on the chain and support new enterprise tools. The investment round was lead by Polychain and Three Arrows Capital with other angel investors and family offices buying into the network through a private token sale.

📢 BIG News 📢@Polychaincap and Three Arrows Capital led a $230M investment in the #Avalanche ecosystem to support growth of the platform.https://t.co/T141NFEoIG

— Avalanche 🔺 (@avalancheavax) September 16, 2021

Avalanche founder and Avalanche Foundation director Emin Gün Sirer said, “This will go to fostering the growth of the DeFi ecosystem, NFTs, collectibles, and also some new innovative systems that are coming out on top of this.”

The price of AVAX (the native token of Avalanche) reached an all-time high near $76 on September 19th following the bullish news. At the time of writing, AVAX stands as the 11th largest cryptocurrency by market capitalisation and has become one of the top 10 coins when excluding stablecoins.

Insider Trading Allegations Rock OpenSea, NFT Marketplace Responds

OpenSea's head of product, Nate Chastain, was caught trading using insider information after he purchased NFTs that he knew were going to be displayed on the front page of OpenSea.

Hey @opensea why does it appear @natechastain has a few secret wallets that appears to buy your front page drops before they are listed, then sells them shortly after the front-page-hype spike for profits, and then tumbles them back to his main wallet with his punk on it?

— ZuwuTV.eth 👻🎃🦇 (@ZuwuTV) September 14, 2021

Since the OpenSea marketplace operates on Ethereum and given the transparent nature of the blockchain, Twitter user ZuwuTV was able to spot Chastain's suspicious activity and raise the alarm on September 15th.

OpenSea then admitted the individual was involved in malicious trading behaviour, as well as accepting his resignation, and announced a new policy whereby employees would not be able to trade NFTs while they are featured or promoted on the OpenSea marketplace. In positive news, the company announced the launch of a mobile app for iOS and Android on September 17th.

Other News

- Ethereum co-founder Vitalik Buterin named one of the top 100 most influential people of 2021 by TIME magazine,

- Solana saw its first ever million dollar NFT sale for Degen Ape #7225 on September 11th, which was bought by Moonrock Capital,

- Moonray is building a Play-to-Earn RPG based on Bitcoin, built using Stacks,

- EY announced they'll be utilising Polygon's protocol and framework to deploy its own EY blockchain solutions onto Ethereum,

- Bitcoin Core developers release the first software with support for November's Taproot upgrade.

Market Analysis 📈📉

7-day Price Change

- BTC: -6.7%

- ETH: -12.5%

- ADA: -21.5%

- BNB: -13.2%

- XRP: -18.6%

- SOL: -23.3%

- DOGE: -17.8%

- LINK: -19.8%

- LTC: -13.8%

- TRX: -18.0%

Data as of September 20th, 19:30 UTC

Let's look at the Bitcoin chart.

After a red week for the cryptocurrency market, BTC-USD has tested the September low on Monday, posting a new low near $42,000. Looking at the weekly chart, the price of bitcoin is nearing the support level provided by the middle Bollinger Band at ~$40,800. A weekly close below this level would signal weakness in the market and a possible test of $40,000.

The daily chart is shown below with Bitcoin testing the lower Bollinger Band (at $42,840) which has usually presented a good buying opportunity. For example, the last time BTC-USD tagged the lower band was on September 13th, where the price hit a low of $43,465 before rising to $48,475 two days later.

However, the price could continue downwards and hug the lower band in the days ahead. Therefore, traders may want to confirm a bottom by waiting for a push higher with strong buying volume to buy Bitcoin.

Ethereum and other altcoins dropped by a larger percentage than Bitcoin over the past seven days. The daily chart for ETH-USD is shown below and looks similar to Bitcoin’s, but note that this is the first time ETH has tagged the lower Bollinger Band since July 2021, suggesting a good opportunity to buy. However, if there’s a daily close below the $3,000 psychological level, then we may see further downside as buyers have defended this important level since early August.

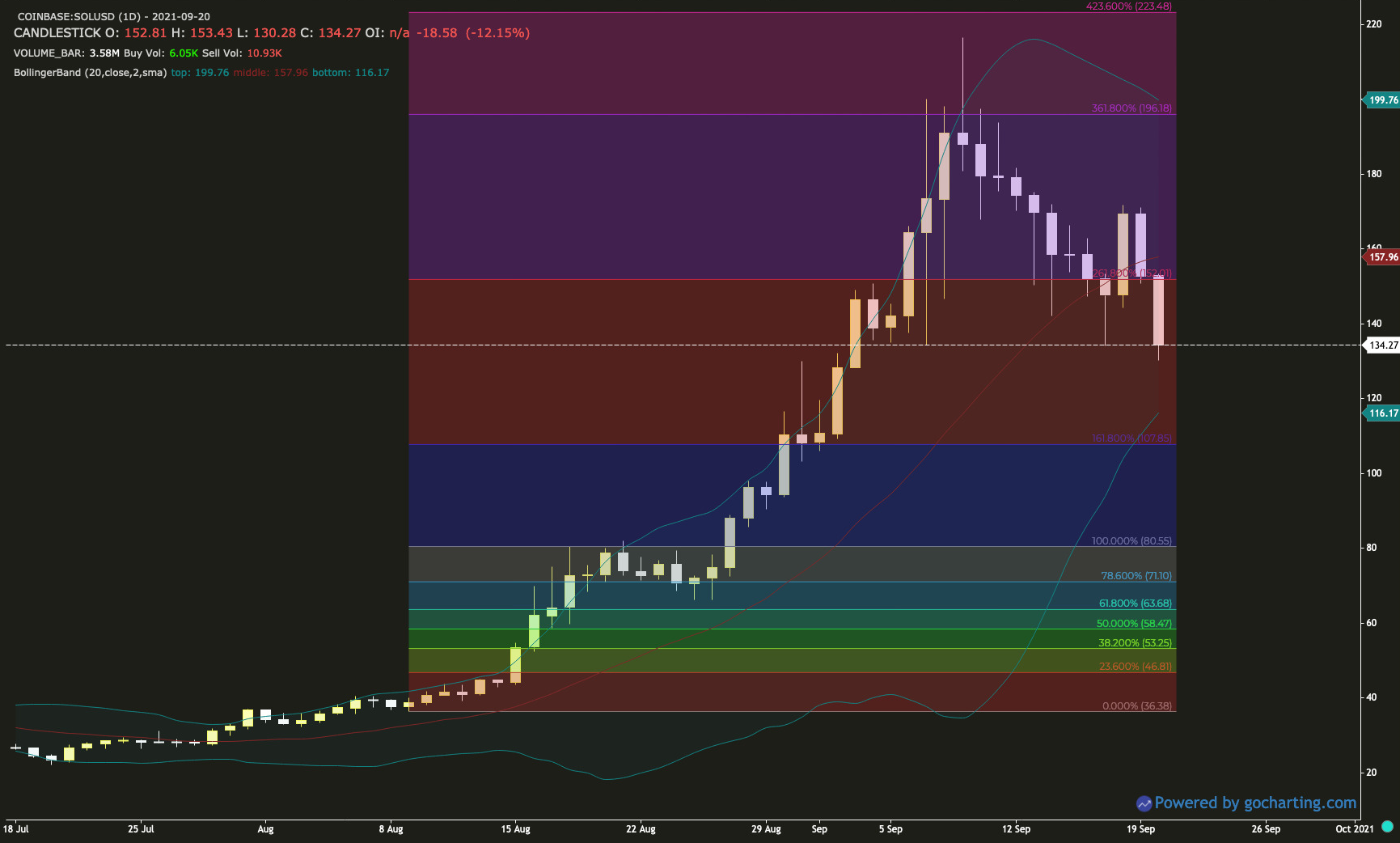

The price of SOL broke through the Fibonacci level, providing support at ~$151. It looked as if the level held, but on Monday's cryptocurrency market downturn, SOL-USD reached a fresh low of $130. With support at $152 failing, the next levels to watch are $116.26 (the lower Bollinger Band) and $107.85 (the next Fibonacci support level).

Ideally, we'd need SOL-USD to recover the $152 to see a continuation of the uptrend, but it looks as if a tag of the lower Bollinger Band is imminent.

Have a great week!

-The Rollbit team